Mortgage Rates Plummet in Texas: Is Now the Time to Make Your Move?

Good news for prospective homeowners – mortgage rates are at their lowest since May 2023. As of December 16, 2024: 30-year fixed mortgage: 6.85% in Texas (slightly above the 6.78% national average. ) 15-year fixed mortgage: 5.98% in Texas.

The Lone Star State's real estate landscape continues to evolve, presenting both challenges and opportunities for homebuyers, sellers, and investors. Let's dive into the latest trends shaping the Texas mortgage and refinance market as we close out 2024.

Home Prices: Steady Growth with Regional Variations

The Texas real estate remains relatively stalled, with the median home sale price reaching $345,000 in Q2 2024, marking a modest 0.6% year-over-year increase. However, there are certain markets that are outpacing the state average:

- Odessa: 11.7% price increase

- Abilene: 11.1% price increase

These figures highlight the importance of local market knowledge when considering property investments or home purchases in Texas.

Mortgage Rates: A Silver Lining for Buyers?

What are the different kinds of home loans, anyway?

There have been, and always will be, a trillion loan products for homeowners to choose from, some have held up to the test of time better than others – today mortgage rates are at their lowest since May 2023. Here’s a breakdown of the most common mortgage loan types:

As of December 16, 2024:

- 30-year fixed mortgage: 6.85% in Texas (slightly above the 6.78% national average)

- 15-year fixed mortgage: 5.98% in Texas

With positive inflation data sometimes correlates with further easing of rates, so now might be an opportune time to lock in a mortgage if you have been sitting on the sidelines to make a move.

Refinancing: Weighing the Options

While current property values may seem attractive for cash-out refinancing, it's essential to compare today's rates with your existing mortgage. The national average refinance APR stands at 6.79%, which may not be competitive for homeowners who secured lower rates in recent years.

Market Dynamics: Shifting Towards Buyers

The Texas housing market is showing signs of correcting:

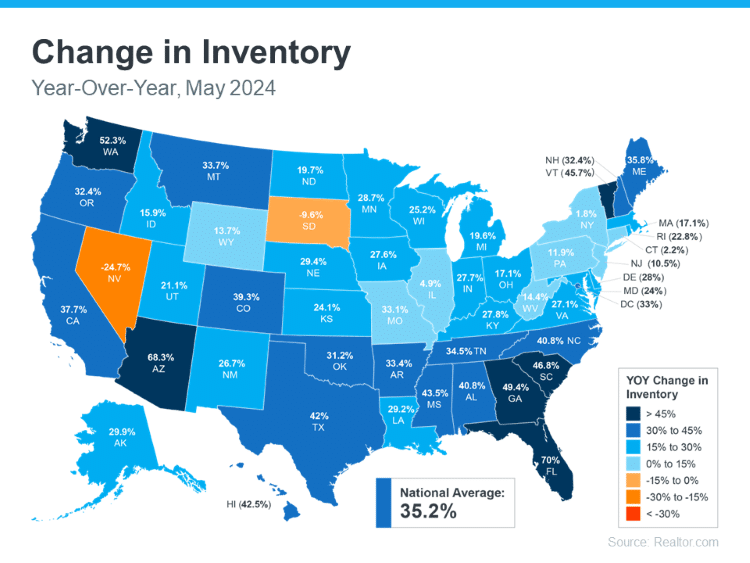

- Active listings up 41% since Q2 2023

- Housing supply increased to 4.6 months of inventory (up from 3.1 months in Q2 2023)

- Price drops in key markets like Austin-Round Rock-San Marcos, Lubbock, San Antonio, and Texarkana

This shift provides more options and potentially greater negotiating power for buyers, y’all.

Texas Mortgage Options: Finding the Right Fit

Mortgages and First Time Buyer Programs come in as many shapes and sizes as there are choices of paper towel brands at your favorite Walmart. Here’s a break down of what is currently out there to explore:

1. Conventional Mortgages: Ideal for borrowers with strong credit (620+ score) and stable income.

2. FHA Loans: Great for first-time buyers or those with lower credit scores (minimum 580).

3. VA Loans: Excellent option for veterans and active military personnel.

4. USDA Loans: Perfect for rural property purchases with no down payment required.

5. Jumbo Loans: Necessary for high-value properties exceeding conforming loan limits.

First-Time Homebuyer Programs in Texas:

Texas offers several programs to make homeownership more accessible:

1. My First Texas Home: Lower monthly payments and down payment assistance.

2. Homes Sweet Texas Home Loan Program: Down payment assistance grants up to 5% of the loan amount.

3. Homes for Texas Heroes Home Loan Program: Tailored for specific professions like police officers, teachers, and veterans.

4. Mortgage Credit Certificate (MCC): Homebuyers can claim a dollar-for-dollar tax credit for up to $2,000 of their annual mortgage interest. The credit is based on the mortgage amount, interest rate, and an "MCC percentage" set by the Housing Finance Agency (HFA).

Cool Down Just In Time For Winter?

The market is correcting, my friends, potentially favoring buyers with increased inventory and steadying prices.

Current mortgage rates today are attractive, however there is no consensus amongst industry pros surrounding where rates will go in 2025. Some experts think they will stay in the mid 6% range, some protect they could go as high as 11%, depending on how inflation evolves (or hopefully not).

REMEMBER: Local market conditions vary significantly, make sure you have local experts that know your market!

As we move into 2025, I’ll keep helping you stay informed about these trends to make the best decisions for your Texas real estate journey. Whether you're a first-time homebuyer, looking to refinance, or considering an investment property, understanding the current market dynamics is crucial for success in any real estate market.

What do you think? Is there anything in particular you’ve noticed happening in your market? I’d love to hear about it, use the form below!

Media Changes Tune On Housing Market (Crash Is Here)(?)(!)

Are you feeling the pressure to buy a house right now? The media is sending mixed messages about the housing market, making it difficult to know what to do. Don't be fooled by their fear-mongering tactics. This article analyzes current market trends, including home prices, mortgage rates, and inventory levels, to help you make informed decisions about your real estate journey. Discover the truth about the housing market and gain valuable insights to navigate its complexities.

Are you as confused and annoyed by the mixed signals we are getting lately about where mortgage rates are going? You’ve heard the media telling us...if you don't buy a house now you will be MISSING OUT!!!

Hmmm...that FOMO peddling sounds vaguely familiar, right? Not too long ago we were "living our best Covid lives" dancing along with pretty TikTok-ers making sourdough bread.

I am to no end annoyed by their predatory messaging: Hey kids if you don't buy a house now, you WILL be missing out on the greatest opportunity for wealth in your entire lifetime.

Hold up. The truth is, you cannot trust mainstream media when they tell you that when the Fed continues to do rate cuts, mortgage rates will get down to 4% or even 3%. A few months ago mainstream media were telling folks ‘don't worry mortgage rates will go down as the Feds keep cutting’, as if what the Fed does with interest rates have any influence on how mortgage rates behave. Now they are telling you the opposite...y'all better buy a house now, because if you don't you will be in an even worse position because mortgage rates will continue to go up. Mainstream media have completely reversed their tune y'all.

CNN just a week ago put out an article saying that if you didn't buy a home in the last six months when the Fed cut rates...too bad, so sad, you made a mistake. And to add more water to an already boiling over pot, I still hear licensed professionals encouraging folks to date the rate. This, in my opinion, is absolutely the worst advice to hit us since they said skinny jeans make everyone look good. I don’t mean to trivialize what is happening to my neighbors in our housing market by comparing it to the skinny jean trend..but can we all agree that we are happy it’s finally going away?

They are finally right about one thing though: the Fed will likely continue cutting rates through the end of 2024, but this won't make housing any more affordable my friends. In fact, owning a home has never been more costly than it is today. It's hard to watch the news without feeling disheartened by the headlines about massive price drops in Texas, widespread issues in Florida, and a struggling housing market in New York. Property taxes are soaring, HOAs are out of control, and interest rates are expected to remain above 6% for at least the next two years. (Of course, this rate prediction comes from the National Association of Realtors, one of the largest lobbying groups in the U.S., so take it with a grain of salt. *discalaimer, I am a member of NAR).

They claim that if you had purchased a home six months ago, you would be ahead now, but the truth is that anyone who bought recently in those markets is likely seeing their property values plummet. With skyrocketing assessments, record-high home insurance rates, and no assurance that insurance companies will support their clients during crises, the situation looks bleak.

If you feel the pressure is on to buy a house as soon as possible because it's only going to get more expensive, well you're not totally wrong about that. However, you must have your head in the deal game and rely more on what the data is telling you. Rely less on what folks like Barbra Corcoran say when they get up one morning and decide to preach to you in the soft light of the CNN or FOX studios. This isn't an episode of the Shark Tank..this is your financial health, so take the data seriously. Let's dive in and talk numbers shall we?

Analyzing the Current Market

Seasonal Trends in Home Prices and Mortgage Rates

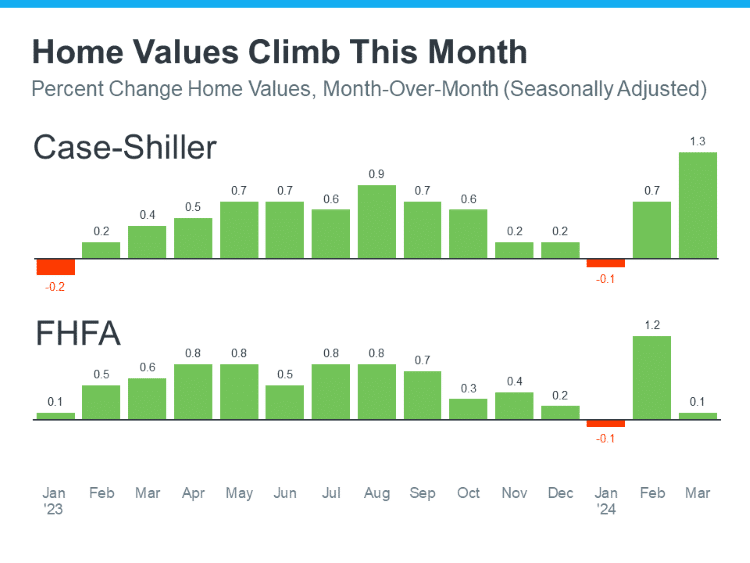

As we delve into the current state of the housing market, it's evident that there are seasonal fluctuations influencing both home prices and mortgage rates. Typically, home prices peak during the late summer months, as observed in June 2023, and similarly in previous years. This pattern aligns with the data from June 2022 and the peak around June and July in 2023.

Historical Context and Mortgage Rate Fluctuations

In January 2021, mortgage rates reached an unprecedented low of approximately 2.7%. This significant decrease sparked a notable rise in home prices later that year, especially in August, when the average rate for refinancing stood at around 2.75%. These exceptionally low rates played a crucial role in driving up home prices as the year progressed.

Year-Over-Year Home Price Changes:

2021 : Home prices saw a significant increase, up by 18% year-over-year, which was an unsustainable surge in the market.

2022: The increase was more moderate at 8%, reflecting a slight cooling from the previous year.

2023: Currently, home prices are up by approximately 4% from the same time last year, indicating a return to more normal growth rates in the range of 3-5%.

Mortgage Payments and Interest Rates

*Rates go up from July to August 2024

In August 2024, the average monthly mortgage payment rose to $2,667, calculated at an interest rate of 6.78% according to Freddie Mac's latest data as of August 1st. This rate is based on a weekly survey and may differ from daily rates, which were lower at the end of the first week. Despite this, the current mortgage payment is only $168 below the all-time high set a few months ago, reflecting the ongoing pressure on affordability. If it seems like there are forces invisible to the naked eye contributing to what influences mortgage rates, you have good intuition.

The mortgage industry has long advised homebuyers to follow the "30% rule," which suggests that housing expenses, including mortgage payments, should not exceed 30% of one's income. This guideline has traditionally been used to determine an acceptable debt-to-income ratio for homebuyers. However, the NerdWallet quarterly First-Time Homebuyer Affordability Report indicates that adhering to this principle has become increasingly difficult in the current real estate market, primarily due to rapidly rising home prices.

Dynamics of Current Home Sales and Listings

Pending Home Sales

Pending home sales, a leading indicator of housing market activity, fell by nearly 6% in the four weeks ending July 28th. This is the largest decrease in nearly nine months, which could be a precursor to changes in the market, especially considering the recent drop in interest rates.

New and Active Listings

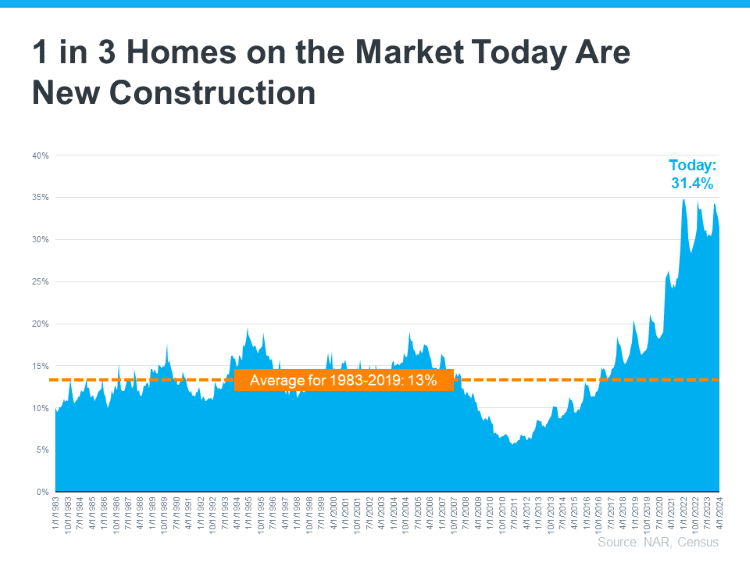

While new listings increased by 4%, this was the smallest increase in nearly nine months. Active listings, which represent the total housing inventory, rose by nearly 19%, yet this too was the smallest increase in about three months.

These trends suggest that while there is a decrease in demand, the inventory is not increasing at a rate that would suggest a market crash.

Analyzing the Supply and Demand

The supply side shows a modest (not substantial..calm down NAR) 4% year-over-year increase in new listings, significantly lower than the double-digit increases seen earlier in the year. On the demand side, there's a notable decrease in pending home sales , with a 5.7% drop from the previous year, indicating a significant reduction in buyer activity. This decrease in pending sales is a critical factor to watch, as it could signal a potential shift in the market dynamics.

Active Listings and Inventory Trends

Active listings have shown an unusual pattern, peaking in June rather than the late summer months, which is atypical for the housing market. This early peak suggests a shift in the usual seasonal trends and could impact future home prices and market stability. Despite this peak, we are still experiencing a three-year high in active listings for the same timeframe, indicating a more robust inventory than in recent years.

Month Supply of Homes

The current month supply of homes stands at 3.8 months, which is an increase of 0.8 percentage points from last year. This figure represents how long it would take to sell all current listings at the current sales pace if no new listings were added. A balanced market typically has a 4-5 month supply, so while we are closer to this range, the market still slightly favors sellers.

Variations in Regions and Metro Analysis

Different regions and metros are experiencing varying trends:

Detroit, Michigan: Leads with a significant increase in median sale prices, up by 17.2% year-over-year.

New Brunswick, New Jersey: Follows with a 15% increase.

Providence, Rhode Island and Milwaukee, Wisconsin: Both have seen substantial price increases of over 13%.

Conversely, Austin and Dallas have seen slight decreases in home prices, indicating regional disparities in market conditions.

Market Predictions and Future Trends

Looking ahead, the housing market's future will largely depend on the interplay between supply and demand. If pending home sales continue to decrease and new listings do not rise significantly, we could see a shift towards a more balanced or even a buyer's market. However, the current data suggests a gradual adjustment rather than a sudden market downturn.

Food for thought: Two things can be true at once: It will be a buyer's market for awhile, and buyers are priced out.

Impact of External Factors

External factors such as economic policies, interest rates, and global events also play a crucial role in shaping the housing market. For instance, any changes in federal interest rates can directly impact mortgage rates, influencing both buyer affordability and market dynamics.

The housing market is exhibiting signs of a gradual shift towards normalization after the unprecedented fluctuations of the past few years. While the market still slightly favors sellers, the increasing month supply and regional variations indicate that we may be moving towards a more balanced market. Homeowners, buyers, and investors should keep a close eye on these trends as they plan their next steps in the housing market.

The month supply of homes, a critical indicator of market balance, has seen a noticeable increase this year. As of now, the month supply stands at 3.8 months, up from 3 months at the same time last year. This increase is part of a seasonal trend observed in June and July each year, with the exception of 2021 when the market experienced near-record low rates.

Historical Perspective on Month Supply

July 2019: Month supply was at 4.2 months.

July 2018: Month supply stood at 4.3 months.

July 2017: The figure was again at 4.2 months.

July 2016: Month supply was higher at 4.7 months.

The average for July from 2016 through 2019 was approximately 4.4 months, indicating that while the current supply is a three-year high, it is still below the historical norms of pre-COVID levels.

Regional Analysis of Home Prices and Sales

The dynamics of home prices and sales vary significantly across different regions and metros. Here’s a closer look at some specific areas:

The Top Performers in Home Price Increases:

Detroit, Michigan: Led the nation with a 17.2% increase in median sale prices year-over-year.

New Brunswick, New Jersey: Saw a 15% increase.

Providence, Rhode Island and Milwaukee, Wisconsin: Both experienced significant increases, with Providence at 13.6% and Milwaukee at 13.3%.

The Metros with Declining Home Prices:

Austin, Texas: Experienced a decrease of 2.3%.

Dallas, Texas: Saw a slight decrease of 4%.

Pending Home Sales Insights

Gains: Only seven metros posted gains in pending home sales from the previous year, including San Francisco, California, and Miami, Florida, which saw increases of 3.2% and 2.8%, respectively.

Losses: The majority of metros experienced declines, with significant drops in cities like Phoenix, Arizona, and Las Vegas, Nevada, where pending sales fell by 5.7% and 6.1%.

Understanding the Shifts in Market Dynamics

Real estate markets dance to their own tuned and are hyper local, with home prices and sales fluctuating from region to region. While some areas enjoy robust growth, others grapple with declines, reflecting the diverse economic and demographic forces at play. These localized trends are crucial for both homebuyers and investors to understand before making any decisions.

The Influence of Economic Policies on Regional Markets

Economic policies, including tax incentives and zoning regulations, significantly impact regional real estate markets. For instance, areas with favorable tax conditions and growth-friendly policies tend to attract more residents and investors, which boosts home prices and sales activity. Conversely, regions with restrictive policies may see a stagnation or decline in market dynamics.

Future Outlook and Strategic Considerations

As we move forward, the real estate market will continue to adapt to the ongoing economic and demographic shifts. To make informed decisions, it's crucial to stay updated on national trends and local market conditions. If you have any questions about the Texas real estate market in particular, call me! There isn’t a whole lot I love more these days than talking real estate.

Strategic Buying and Selling Tips

For Buyers: Focus on areas with strong economic growth and stable job markets. Consider the long-term potential of the area and factor in the total cost of homeownership, including taxes and insurance.

For Sellers: Emphasize the unique features of your property and community. Be realistic about pricing, especially in markets experiencing a slowdown. Timing is everything, there are ways to make sure that your sale coincides with peak buyer activity in your region.

Navigating Market Uncertainties

The real estate market is inherently unpredictable y’all. Understand the underlying factors. By being adaptable, you will be able to navigate these challenges with efficiency. The key is: BE ADAPTABLE. Whether you're a first-time homebuyer or on your tenth investment property. Staying informed is a discipline. Adjusting your strategies accordingly is the key to not loosing your shirt.

FOCUS ON PURCHASE PRICE, NOT RATES!

The real estate market is a complex and dynamic lover my friends, influenced by a world of seemingly invisible factors such as economic policies, demographic shifts, and regional disparities. It’s VERY easy to be seduced by her. The good news is, you can have a healthy relationship with your housing market. By analyzing these elements and staying informed, you can make more strategic decisions and navigate the market with greater confidence and less risk.

As we move forward, it will be interesting to see how these trends evolve and shape the future of real estate.

Remember, whether you're buying, selling, or monitoring the market, knowledge is your most valuable asset! There are no stupid questions. Drive slow, the jerk on your back bumper will go around and be no further than you are by driving like an animal. Stay informed, stay flexible, and stay proactive in your real estate endeavors.

What are your observations and experiences in your local market? I'd love to hear about them! Feel free to share your insights, whether you're noticing similar trends or experiencing something different, as they can help me to better understand the broader market dynamics.

What will the Donald Trump presidency mean for the US housing market in 2025?

Well, folks, it happened! The Trump Train rolled right back into the White House, and now we're all wondering what this means for our real estate market. Buckle up buttercup, because we're about to take a wild ride through what the red, white, and gold-plated world of Trump's second term could mean for real estate!

Well, folks, it happened! The Trump Train rolled right back into the White House, and now we're all wondering what this means for our real estate market. Buckle up buttercup, because we're about to take a wild ride through what the red, white, and gold-plated world of Trump's second term could mean for real estate!

Remember when we thought 2020 was unpredictable? Ha! Welcome to 2025, where the housing market might just be as dramatic as that reality TV season finale you all know you DVR’d!! But don't worry, I’m here to be your personal "Art of the Deal" decoder ring.

So, what's on the landscape for the next four-years? Will we see more apartment buildings and skyscrapers sprouting like weeds? Are we in for the potential of home prices rising? Or will the market be as plateaued as Trump's famous coif?

I’ll get into all the juicy details faster than you can say "You're fired!" at a bad property listing. From potential tax shakeups to infrastructure bonanzas, it’s going to be an interesting first year back in the Oval Office for Trump. My goal is to help translate all the political talking head’s jargon into real talk for your real estate decisions. Ready to make your real estate portfolio great again? Let’s dive into it.

The Influence of Trump's Election on Mortgage Rates

One of the first questions that comes to mind with Trump's election is: How will it affect mortgage rates? Interestingly, there has been a noticeable spike in mortgage rates since mid-September, with rates climbing back to around 7%. This rise has left many puzzled about the underlying causes. A significant factor to consider is the "Trump trade." A tweet from Jim Biano, president of Bianco Research,LLC highlighted a correlation between Trump’s betting odds to win the election and the 10-year US Treasury yield. As Trump's odds increased, so did long-term interest rates, suggesting that the market anticipates higher long-term rates under Trump's presidency.

Despite Trump being a pro-business figure who has historically pressured the Federal Reserve to cut interest rates, his presidency might paradoxically be associated with higher borrowing costs. This could potentially dampen home buyer demand. The Committee for a Responsible Federal Budget estimates that US debt will rise by $7.8 trillion from 2026 to 2035, largely due to Trump's fiscal policies. Moreover, Trump's penchant for tariffs, including a proposed blanket tariff of 10-20% on all imports and even higher tariffs on goods from China, could lead to inflationary pressures, further pushing up interest rates and mortgage rates.

Trump's Potential Impact on Home Buyer Confidence and Market Dynamics

Despite the possibility of higher mortgage rates, Trump's pro-business stance could boost economic confidence and optimism about the housing market. This was evident from past data, such as the mortgage purchase application index, which saw a significant increase following Trump's election in 2016. This suggests that Trump's election could initially inspire confidence among potential home buyers, potentially stabilizing or even increasing home prices.

Slow down though! The current state of the housing market presents new challenges. Affordability metrics are at their worst, with the monthly cost of buying a home now reaching $2,800, a stark increase from $1,200 when Trump first took office. The typical home buyer now spends 40% of their income on mortgage costs, up from 24% in 2016. High mortgage rates and continuing stringent qualification criteria for mortgages might (could and would) continue to lock out many prospective buyers, raising questions about the real impact of presidential policies on the housing market's fundamental issues.

The Looming Threat of Foreclosures and Government Intervention

Looking ahead to 2025, another significant concern is the potential increase in foreclosures. Trump's less hands-on approach compared to the Biden-Harris administration could see a rollback of forbearance and loss mitigation efforts that have so far prevented many foreclosures. Data from the November ICE Mortgage Report, The nation's leading source of mortgage data and performance information, covering most of the market, indicates a worrying trend: early-stage delinquencies for 2024 vintage originations have reached 1.7%, the highest in 16 years. This spike in delinquencies, particularly among VA and FHA loans, could herald a wave of foreclosures, especially if Trump reduces government intervention in the mortgage market.

The Biden-Harris administration has taken steps to help prevent foreclosures, like automatically enrolling borrowers who've fallen behind on their payments into more affordable plans and making it tougher for lenders to take away their homes. While some folks have raised concerns about using taxpayer money to help homeowners who don't have much equity in their properties, the goal is to keep people in their homes and avoid the chaos that comes with a surge in foreclosures. If the Trump administration were to reverse these policies, it could lead to a rise in foreclosures, which could have a ripple effect on the housing market and even drive down home prices.

The Role of Fannie Mae and Freddie Mac in Trump's Housing Policy

Get ready for a potential shake-up in the world of government-backed mortgages, y’all! The Trump administration is considering privatizing Fannie Mae and Freddie Mac, two giants that support around half of all mortgages in the US. If they sell off a chunk of their government stake to private investors, it could significantly reduce the government's role in the housing market - a move that aligns with Trump's more hands-off approach to economics.

So, what does this mean for the housing market? Well, privatization could lead to higher mortgage rates since the government's backing would be reduced. This could make it tougher for buyers to afford homes and impact market stability. On the other hand, it could also lead to more competitive practices in the mortgage lending market, which could be a good thing!

*Fannie Mae financed home purchases for millions of American soldiers returning from World War II. The nation’s economy grew rapidly and the liquidity Fannie Mae provided allowed mortgage lenders to have the cash on hand to meet the demand.

Are you wondering who Fannie Mae and Freddie Mac are? They're two government-sponsored enterprises (GSEs) that play a huge role in the US housing market. Fannie Mae was created in 1938 to provide financing for homeownership, while Freddie Mac was established in 1970 to provide financing for multifamily housing. Today, they're responsible for backing around half of all mortgages in the US, which is a whopping 31 million mortgages!

The short to the long of it is: Fannie Mae and Freddie Mac buy mortgages from lenders, package them into securities, and sell them to investors. This allows lenders to make more loans and helps keep mortgage rates low. The government provides a guarantee to these securities, which makes them more attractive to investors. By privatizing these institutions, the government would be reducing its role in the housing market and allowing private investors to take on more risk.

It's worth noting that privatization is just a proposal at this point, and there are many details that still need to be worked out. But if it does happen, it could have significant implications for the housing market and the millions of Americans who rely on Fannie Mae and Freddie Mac for their mortgages.

Trump, Tariffs, and Tangles: Will the Housing Market Duck or Dive?

As we look ahead to Trump's presidency, it's clear that the broader economic landscape and the Federal Reserve's policies will have a huge impact on the housing market. And let's just say, Trump's relationship with Jerome Powell, the head of the Federal Reserve, has been a bit rocky. Trump has publicly criticized Powell and has been pushing for lower interest rates. The Fed's decisions, especially when it comes to interest rates, will play a huge role in shaping the direction of the housing market.

Trump's economic plans, which include big tax cuts and potentially aggressive tariffs on imports, could give the economy a short-term boost. But they could also lead to higher inflation and increased costs for consumers. And that's where things will get real interesting - these factors could either help or hurt our housing market, depending on how they interact with other economic factors like wage growth and employment rates.

For instance, if wages start to rise and people have more money in their pockets, they might be more likely to buy or invest in homes. On the other hand, if tariffs lead to higher prices for building materials and other goods, that will make it harder for builders to keep costs down and for buyers to afford homes. So, it's a complex picture my friends. Which will come first? The chicken or the egg? Will wages go up? Will building get cheaper? Unfortunately, we'll just have to live through these factors playing out to get a true sense of what the future holds for our housing market under Trump's presidency.

What’s Good in the Hood? The Importance of Being Aware of Local Market Fundamentals

While national policies and economic trends are important, the most critical factors for home buyers and investors are often local market conditions. Understanding the fundamentals of your local housing market, such as cap rates and historical price trends, is critical for making eyes wide open decisions. Cap rates, for example, provide valuable insight into the potential return on investment in different regions and can indicate whether it's a favorable time to buy or invest in a particular area…so don’t ignore them!

When it comes to investing in a single-family rental home in Texas November 2024, the right capitalization rate (cap rate) depends on a few key factors. First and foremost, there's your personal risk tolerance. Are you looking for a steady income stream with minimal risk, or are you willing to take on more risk in pursuit of potential growth? If you're looking for stability, a cap rate of 4-5% might be the way to go. But if you're willing to take on more risk, a cap rate of 8-12% could be more appealing.

Some investors, particularly those with a more aggressive approach, tend to shy away from properties with cap rates below 8%. In fact, some may even require double-digit returns. However, it's essential to consider the diverse range of factors influencing investment decisions. A cap rate of around 6% can be considered exceptionally attractive in the market you are buying in! In Texas, for example, many homeowners have low mortgage rates, which can limit the supply of homes available for purchase. This can impact the cap rate you're looking for.

Finally, the property itself is a major consideration. What's the property's location, condition, and potential for renovation or redevelopment? These factors can all influence the cap rate you're looking for.

By considering these factors, you can get a better sense of what cap rate is right for you and your investment goals.

Will 2025 Be Better?

As we head into the new year, it's clear that the housing market is in ongoing trouble, and we're looking at a complex web of factors that will shape the market's direction. From new government policies (or lack there of) to economic strategies and the actions of the Federal Reserve, there’s a dizzying array of things to keep track of.

But here's the thing: while it's important to stay informed about national trends, it's your local market that will ultimately make or break your real estate decisions. This is not a new rule, it has always been the case. Whether you're a home buyer or investor, understanding what's happening in your own backyard is crucial. Too many get suckered into the shiny sales pitch before we do our homework.

So, what does this mean for your action plan? It means staying informed about both national trends and local conditions keeping an eye on the big picture, but don't lose sight of what's happening in your own community! Pay attention to your city government. Go to those city council meetings! Be a sponge! By doing so, you'll be better equipped to navigate and possibly predict the chaos of the real estate market in 2025 and beyond.

In the end, while geeking out on macroeconomic and political climates is certainly an important activity, it's really understanding local housing market dynamics that will ultimately hold the key to shooting for success in real estate investment and homeownership. Stay informed, stay local, and get ready to make some moves in the 2025!

AGAIN REMEMBER KIDS: ALL REAL ESTATE IS LOCAL, even if the White House looks more like Mar-a-Lago these days. Do you know what else is local? You are! It’s impossible to predict what the housing market under Trump will look like this time around. What you can know is that neighborhood and financial knowledge is POWER.

And don’t forget to get your buyer’s agency with a REALtor in your neck of the woods. If you’re in Texas…I’ll help you navigate your neighborhood market, whether you're in a blue county, a red county, or somewhere in the purple haze in-between!

Why Are Mortgage Rates Rising? Here’s What You Need to Know!

If you've been following the recent fluctuations in mortgage rates and wondering how they might impact your home-buying journey, you're not alone. I want to share a story that illustrates the importance of acting decisively in this market.

If you've been following the recent fluctuations in mortgage rates and wondering how they might impact your home-buying journey, you're not alone. I want to share a story that illustrates the importance of acting decisively in this market.

Recently, I had a client who was eager to rightsize into a new home in Canyon Lake, TX. We spent this entire year (I kid you not) walking properties and hunting for his vision, when we FINALLY found something he was really excited about. However, he held off on making an offer because he was convinced that when the Federal Reserve dropped interest rates last month, mortgage rates would surely follow suit. Now, I’m a closeted economics nerd and I follow a lot of the Academic Economists on the University of YouTube, and I told him that the word on the street is that rates will probably go up before Christmas.

Unfortunately, he hesitated just a little too long and he lost out on that property. The waiting has led us to a point where we might need to spend several more months searching for a comparable property. This experience is a reminder that while it’s natural to want the best deal, timing is crucial in real estate. Let’s dive into what these changing rates mean for you and how to navigate the current landscape with a little less wear and tear on our internal hope heart regulators, y’all.

Source: Reventure App

What’s Happening with Mortgage Rates?

You might think mortgage rates would’ve droped after the Federal Reserve recently cut interest rates. Instead, they’re climbing! Right now, the average rate for a 30-year mortgage is around 6.4%, which is more than a quarter-point higher than just a couple of weeks ago. So, what’s going on?

The Fed’s Role: The Federal Reserve influences mortgage rates, but they don’t set them directly. Instead, mortgage rates often follow the yield on 10-year Treasury bonds. Recently, that yield has gone up because investors think the Fed might be more cautious about cutting rates again.

Lender Costs: When you get a mortgage, lenders add on their own fees to cover costs and make a profit. Your specific rate will also depend on your credit score and the type of loan you choose.

Comparative Rates: Even with the recent rise, mortgage rates are still lower than they were last year. This has allowed many homeowners to refinance, meaning they can switch to a new loan with a lower interest rate, saving them money each month.

What’s Next for Mortgage Rates?

Predicting where mortgage rates will go is tricky because they depend on various factors. Experts generally agree that we probably won’t see super-low rates like we did a few years ago. For example, back in 2019, rates were between 3.75% and 4.5%. Now, they might stabilize around 6% by the end of this year.

According to Lawrence Yun, an economist at the National Association of Realtors, we might be looking at a “new normal” where rates hover around 6%. He believes that seeing rates drop to 3% or 4% again is unlikely.

Should You Buy a House Now or Wait?

The decision to buy a house feels kind of comparable with deciding if it’s a good time (or not) to have a baby…is there ever the perfect time? With rates changing, you might be wondering whether to jump into the housing market or hold off. Here’s the deal: experts suggest it’s better not to wait for rates to drop for a couple of reasons:

Refinancing Possibility: If you buy now and rates go down later, you can refinance your mortgage to get a better deal. But if you wait and rates go up, you could end up paying more.

Home Prices Rise: Home prices usually increase over time. Waiting could mean you end up paying more for a home down the line. There has been a lot of press lately about how home prices are dropping, but remember that the housing market in one part of the country can behave completely differently 500 miles away. This is why it’s important to find a Realtor you trust in the market you are buying in, they will have their finger on the pulse of your local market.

Interestingly, even people who bought homes when rates were super high (like 15% in the 1980s) often ended up doing well because home values increased over time.

What’s Going On in the Housing Market?

Source: EPB Research

Here’s a silver lining: that inventory problem we have all been hearing about since the beginning of Covid? Well, most major markets are back to pre-pandemic inventory levels! And, according to RE/MAX, the nation wide number of homes for sale went up by 6.4% from last month and is 33.6% higher than last year. Plus, houses are sitting on the market A LOT longer, which in theory means there’s less competition for buyers.

But, here’s the catch: home prices are still pretty high. Since early 2020, the median home price has shot up about 50%. As of August, the median price was around $416,700, which is about 3% more than last year.

Seasonal Trends

The housing market usually gets busier in the spring and summer, slowing down in the fall and winter. This might mean that fall could be a good time to shop, as there might be less competition and more room to negotiate on prices. Sellers are starting to realize that they may have to do significant price cuts to motivate buyers to start making offers again.

Experts predict home sales could rise by 10% next year, but a real bounce-back might not happen until spring.

Still On The Fence? Take Charge of Your Future!

So, what does all this mean for you? If you're thinking about buying a home one day, it’s important to stay informed and ready to act! While rising mortgage rates might sound scary, understanding the situation can help you make smart choices.

If you’re ready to learn more about buying a home or just want to chat about your options, reach out! Let’s navigate this exciting journey together!

#RealEstate #MortgageRates #HomeBuying #FutureHomeowner #InvestInYourFuture #HousingMarket #FinancialLiteracy

Active Listings Comal County

〰️

Active Listings Comal County 〰️

Waiting for Mortgage Rates to Drop? Surprise!! They Went Higher:

The Fed’s decisions are crucial, aiming to boost the economy by lowering borrowing costs. However, mortgage rates don’t always follow suit due to other market dynamics. Sometimes, the Fed’s actions don’t align with market expectations AT ALL, causing major discrepancies and economic data analysts behind closed doors in an assumed crash protection mode heads between knees.

Hey there! So, I was watching this fascinating video on YouTube the other day by Logan Mohtashami, and it really got me thinking about the complex world of economic data and how it impacts mortgage rates. Let me share some insights that are especially useful for first-time homebuyers and seniors looking to downsize.

The Impact of Economic Data on Mortgage Rates

Logan Mohtashami dives into how different economic indicators influence mortgage rates. Despite the Federal Reserve cutting rates, mortgage rates have nudged up slightly. This made me do a double take in despair…why?!! It’s due to a mix of factors he explains in detail which I shall attempt to interpret for those of us who still think sitting in the back of the class makes us cool.

Key Economic Indicators

Mohtashami explaines that metrics such as jobless claims and industrial production offer a glimpse into the state of the economy. For instance, a robust labor market may drive up mortgage rates, as investors anticipate economic expansion. Conversely, when the labor market starts to weaken and unemployment rises significantly, the Federal Reserve, in a frantic attempt to stabilize the economy, resorts to imposing elevated interest rates—an emergency measure intended to guard against being overwhelmed by the surging waves of uncertainty.

The Federal Reserve’s Role

The Fed’s decisions are crucial, aiming to boost the economy by lowering borrowing costs. However, mortgage rates don’t always follow suit due to other market dynamics. Sometimes, the Fed’s actions don’t align with market expectations AT ALL, causing major discrepancies and economic data analysts behind closed doors in an assumed crash protection mode heads between knees. ( Ugh. Don’t get me started about The Fed, I’m trying to keep my blood pressure down.)

Understanding “Spreads” and Their Influence

A critical aspect that affects mortgage rates is the ‘spread’ between financial instruments like the 10-year yield and mortgage rates. Favorable spreads can lower mortgage rates, yet other economic data can offset this advantage. Sure! I'll explain spreads and mortgage rate calculators in a simpler way:

Imagine you're selling lemonade. You buy lemons for $1, but you sell your lemonade for $2. The extra $1 you charge is like a "spread." It's the extra money you make to cover your work and the risk that not everyone will buy your lemonade.

Now, let's think about mortgages (which are big loans people use to buy houses):

Banks lend money to people to buy houses. They charge a bit more interest than they have to pay to get the money themselves. This extra amount is called a "spread." The spread is like the extra $1 you charged for your lemonade. It helps the bank make money and covers the risk that some people might not pay back their loans. A mortgage rate spread calculator is a tool that helps figure out how much extra the bank is charging compared to what they could charge. This calculator takes two numbers:

The interest rate the bank is charging for the house loan

A special number that shows what most banks are charging

It then finds the difference between these two numbers. This difference is the "spread."

If the spread is big, it might mean the bank is charging more than usual. If it's small, the bank might be giving a good deal! People use these calculators to check if they're getting a fair price on their house loan, kind of like checking if the lemonade price is fair at different stands. (You know how those tiny entrepreneurs can be!)

Remember y’all, just like how the price of lemonade can change based on the weather or how many lemons are available, the spread on mortgages can change too, based on what's happening in the world and the economy.

What’s Next for Mortgage Rates?

Looking forward, Mohtashami discusses potential scenarios. Strong economic data might increase rates, while weaker data or a more cautious Fed could lower them. It’s essential to stay updated on economic trends and Fed policies to anticipate changes my friends. Depending on which direction the wind blows it seems lately is how The Federal Reserve makes their decisions these days. Fortunately, I love watching weather and stay up to date.

Housing Market Dynamics

The housing market itself (it’s NOT the FED y’all) influences mortgage rates. Factors like the number of housing starts and sales data reflect economic health, impacting rates. Pro Mortgage Hacker Tip: A dip in housing starts might suggest economic slowdown, potentially lowering rates.

Seasonal Trends

Seasonal trends traditionally also affect rates. There’s often a surge in home buying at certain times, affecting rates. Being aware of these trends can help you time your buying or selling decisions for better outcomes…sometimes. I say sometimes because our housing market the past 4 years has been anything BUT conforming to tradition. My advice: Best not to rely on waiting until next Spring to put your house on the market because that’s what worked for your neighbor last year. Ask yourself, “Is there ever a good time to have a baby, really?”

Navigating Mortgage Rates: Be a Mortgage Hacker!

Yes. I said it. To make informed decisions (and be the coolest one in your friend group), keep an eye on:

Economic Indicators: Watch jobless claims and housing starts to gauge economic direction.

Federal Reserve Policies: Understand how Fed actions might affect rates.

Spreads: Favorable spreads can mean better borrowing conditions.

Seasonal Trends: Recognize patterns in home buying activity.

Now, listen up, my little mortgage hacker babies! Just like you wouldn't buy a car without test-driving a few, don't settle for the first mortgage lender you meet. Rates and packages can be as different as apples and oranges (or lemons, to stick with our theme).

BEFORE you commit to a lifetime of payments that you don’t understand but are stuck with because you don’t have a buyer’s agent rep signed since your uncle who watches too much cable news told you we (agents) are all scammers, do yourself a favor: Shop around! Interview several lenders like you're hosting a reality TV show called "America's Next Top Mortgage." It's seriously important, but it can also be seriously fun because you will learn so much about how these operators work.

Need help finding these lenders? Give your local real estate agent a call (that's me if you’re in Central Texas or want to be!). I've got a roster of lenders that pass my “look me in the eyeballs with integrity” test. Remember, the right lender could save you thousands over the life of your loan. That's a lot of start up capital you could invest in your OWN lemonade empire!

"There have been few things in my life which have had a more genial effect on my mind than the possession of a piece of land." —Harriet Martineau

"There have been few things in my life which have had a more genial effect on my mind than the possession of a piece of land." —Harriet Martineau

Texas law requires all license holders to provide the Information About Brokerage Services to Prospective clients

⭐️⭐️⭐️⭐️⭐️ TESTIMONIALS ⭐️⭐️⭐️⭐️⭐️