Media Changes Tune On Housing Market (Crash Is Here)(?)(!)

Are you feeling the pressure to buy a house right now? The media is sending mixed messages about the housing market, making it difficult to know what to do. Don't be fooled by their fear-mongering tactics. This article analyzes current market trends, including home prices, mortgage rates, and inventory levels, to help you make informed decisions about your real estate journey. Discover the truth about the housing market and gain valuable insights to navigate its complexities.

Are you as confused and annoyed by the mixed signals we are getting lately about where mortgage rates are going? You’ve heard the media telling us...if you don't buy a house now you will be MISSING OUT!!!

Hmmm...that FOMO peddling sounds vaguely familiar, right? Not too long ago we were "living our best Covid lives" dancing along with pretty TikTok-ers making sourdough bread.

I am to no end annoyed by their predatory messaging: Hey kids if you don't buy a house now, you WILL be missing out on the greatest opportunity for wealth in your entire lifetime.

Hold up. The truth is, you cannot trust mainstream media when they tell you that when the Fed continues to do rate cuts, mortgage rates will get down to 4% or even 3%. A few months ago mainstream media were telling folks ‘don't worry mortgage rates will go down as the Feds keep cutting’, as if what the Fed does with interest rates have any influence on how mortgage rates behave. Now they are telling you the opposite...y'all better buy a house now, because if you don't you will be in an even worse position because mortgage rates will continue to go up. Mainstream media have completely reversed their tune y'all.

CNN just a week ago put out an article saying that if you didn't buy a home in the last six months when the Fed cut rates...too bad, so sad, you made a mistake. And to add more water to an already boiling over pot, I still hear licensed professionals encouraging folks to date the rate. This, in my opinion, is absolutely the worst advice to hit us since they said skinny jeans make everyone look good. I don’t mean to trivialize what is happening to my neighbors in our housing market by comparing it to the skinny jean trend..but can we all agree that we are happy it’s finally going away?

They are finally right about one thing though: the Fed will likely continue cutting rates through the end of 2024, but this won't make housing any more affordable my friends. In fact, owning a home has never been more costly than it is today. It's hard to watch the news without feeling disheartened by the headlines about massive price drops in Texas, widespread issues in Florida, and a struggling housing market in New York. Property taxes are soaring, HOAs are out of control, and interest rates are expected to remain above 6% for at least the next two years. (Of course, this rate prediction comes from the National Association of Realtors, one of the largest lobbying groups in the U.S., so take it with a grain of salt. *discalaimer, I am a member of NAR).

They claim that if you had purchased a home six months ago, you would be ahead now, but the truth is that anyone who bought recently in those markets is likely seeing their property values plummet. With skyrocketing assessments, record-high home insurance rates, and no assurance that insurance companies will support their clients during crises, the situation looks bleak.

If you feel the pressure is on to buy a house as soon as possible because it's only going to get more expensive, well you're not totally wrong about that. However, you must have your head in the deal game and rely more on what the data is telling you. Rely less on what folks like Barbra Corcoran say when they get up one morning and decide to preach to you in the soft light of the CNN or FOX studios. This isn't an episode of the Shark Tank..this is your financial health, so take the data seriously. Let's dive in and talk numbers shall we?

Analyzing the Current Market

Seasonal Trends in Home Prices and Mortgage Rates

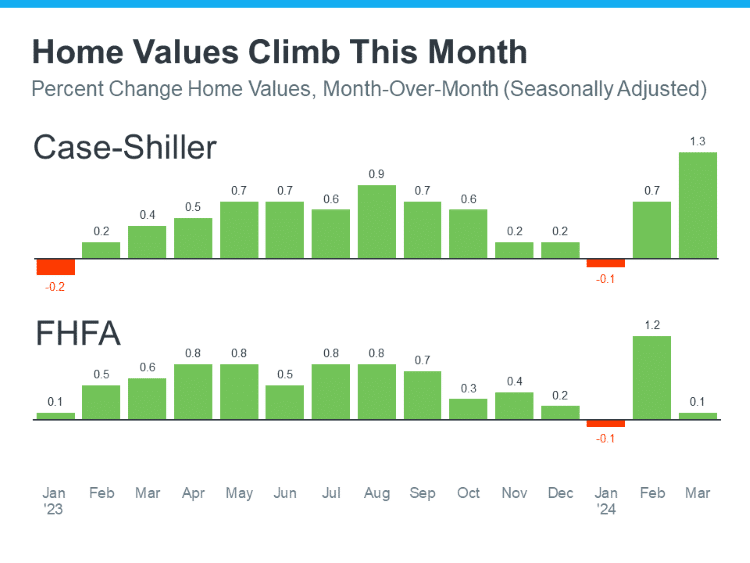

As we delve into the current state of the housing market, it's evident that there are seasonal fluctuations influencing both home prices and mortgage rates. Typically, home prices peak during the late summer months, as observed in June 2023, and similarly in previous years. This pattern aligns with the data from June 2022 and the peak around June and July in 2023.

Historical Context and Mortgage Rate Fluctuations

In January 2021, mortgage rates reached an unprecedented low of approximately 2.7%. This significant decrease sparked a notable rise in home prices later that year, especially in August, when the average rate for refinancing stood at around 2.75%. These exceptionally low rates played a crucial role in driving up home prices as the year progressed.

Year-Over-Year Home Price Changes:

2021 : Home prices saw a significant increase, up by 18% year-over-year, which was an unsustainable surge in the market.

2022: The increase was more moderate at 8%, reflecting a slight cooling from the previous year.

2023: Currently, home prices are up by approximately 4% from the same time last year, indicating a return to more normal growth rates in the range of 3-5%.

Mortgage Payments and Interest Rates

*Rates go up from July to August 2024

In August 2024, the average monthly mortgage payment rose to $2,667, calculated at an interest rate of 6.78% according to Freddie Mac's latest data as of August 1st. This rate is based on a weekly survey and may differ from daily rates, which were lower at the end of the first week. Despite this, the current mortgage payment is only $168 below the all-time high set a few months ago, reflecting the ongoing pressure on affordability. If it seems like there are forces invisible to the naked eye contributing to what influences mortgage rates, you have good intuition.

The mortgage industry has long advised homebuyers to follow the "30% rule," which suggests that housing expenses, including mortgage payments, should not exceed 30% of one's income. This guideline has traditionally been used to determine an acceptable debt-to-income ratio for homebuyers. However, the NerdWallet quarterly First-Time Homebuyer Affordability Report indicates that adhering to this principle has become increasingly difficult in the current real estate market, primarily due to rapidly rising home prices.

Dynamics of Current Home Sales and Listings

Pending Home Sales

Pending home sales, a leading indicator of housing market activity, fell by nearly 6% in the four weeks ending July 28th. This is the largest decrease in nearly nine months, which could be a precursor to changes in the market, especially considering the recent drop in interest rates.

New and Active Listings

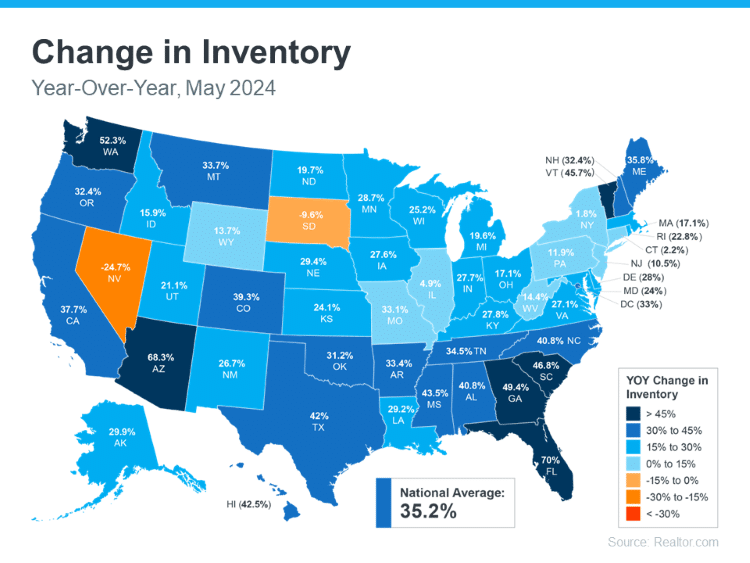

While new listings increased by 4%, this was the smallest increase in nearly nine months. Active listings, which represent the total housing inventory, rose by nearly 19%, yet this too was the smallest increase in about three months.

These trends suggest that while there is a decrease in demand, the inventory is not increasing at a rate that would suggest a market crash.

Analyzing the Supply and Demand

The supply side shows a modest (not substantial..calm down NAR) 4% year-over-year increase in new listings, significantly lower than the double-digit increases seen earlier in the year. On the demand side, there's a notable decrease in pending home sales , with a 5.7% drop from the previous year, indicating a significant reduction in buyer activity. This decrease in pending sales is a critical factor to watch, as it could signal a potential shift in the market dynamics.

Active Listings and Inventory Trends

Active listings have shown an unusual pattern, peaking in June rather than the late summer months, which is atypical for the housing market. This early peak suggests a shift in the usual seasonal trends and could impact future home prices and market stability. Despite this peak, we are still experiencing a three-year high in active listings for the same timeframe, indicating a more robust inventory than in recent years.

Month Supply of Homes

The current month supply of homes stands at 3.8 months, which is an increase of 0.8 percentage points from last year. This figure represents how long it would take to sell all current listings at the current sales pace if no new listings were added. A balanced market typically has a 4-5 month supply, so while we are closer to this range, the market still slightly favors sellers.

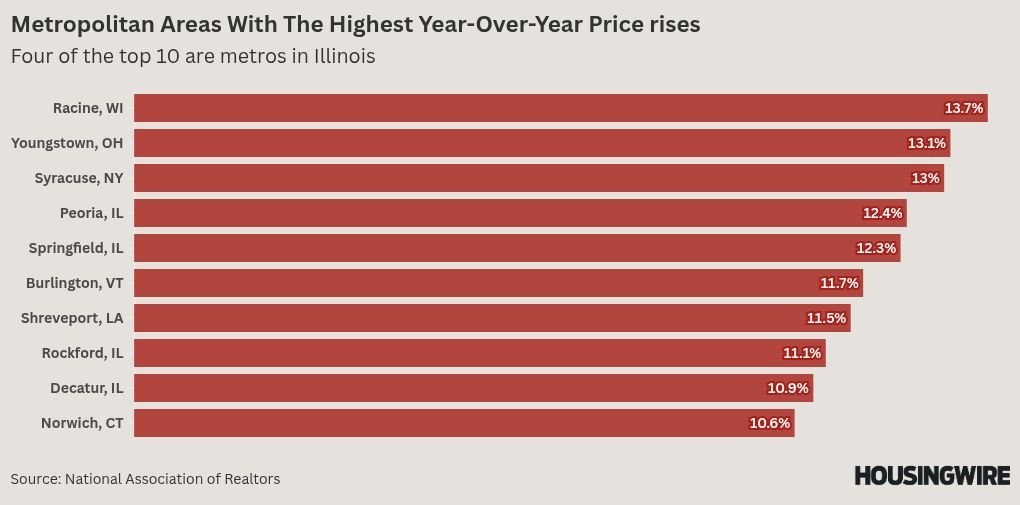

Variations in Regions and Metro Analysis

Different regions and metros are experiencing varying trends:

Detroit, Michigan: Leads with a significant increase in median sale prices, up by 17.2% year-over-year.

New Brunswick, New Jersey: Follows with a 15% increase.

Providence, Rhode Island and Milwaukee, Wisconsin: Both have seen substantial price increases of over 13%.

Conversely, Austin and Dallas have seen slight decreases in home prices, indicating regional disparities in market conditions.

Market Predictions and Future Trends

Looking ahead, the housing market's future will largely depend on the interplay between supply and demand. If pending home sales continue to decrease and new listings do not rise significantly, we could see a shift towards a more balanced or even a buyer's market. However, the current data suggests a gradual adjustment rather than a sudden market downturn.

Food for thought: Two things can be true at once: It will be a buyer's market for awhile, and buyers are priced out.

Impact of External Factors

External factors such as economic policies, interest rates, and global events also play a crucial role in shaping the housing market. For instance, any changes in federal interest rates can directly impact mortgage rates, influencing both buyer affordability and market dynamics.

The housing market is exhibiting signs of a gradual shift towards normalization after the unprecedented fluctuations of the past few years. While the market still slightly favors sellers, the increasing month supply and regional variations indicate that we may be moving towards a more balanced market. Homeowners, buyers, and investors should keep a close eye on these trends as they plan their next steps in the housing market.

The month supply of homes, a critical indicator of market balance, has seen a noticeable increase this year. As of now, the month supply stands at 3.8 months, up from 3 months at the same time last year. This increase is part of a seasonal trend observed in June and July each year, with the exception of 2021 when the market experienced near-record low rates.

Historical Perspective on Month Supply

July 2019: Month supply was at 4.2 months.

July 2018: Month supply stood at 4.3 months.

July 2017: The figure was again at 4.2 months.

July 2016: Month supply was higher at 4.7 months.

The average for July from 2016 through 2019 was approximately 4.4 months, indicating that while the current supply is a three-year high, it is still below the historical norms of pre-COVID levels.

Regional Analysis of Home Prices and Sales

The dynamics of home prices and sales vary significantly across different regions and metros. Here’s a closer look at some specific areas:

The Top Performers in Home Price Increases:

Detroit, Michigan: Led the nation with a 17.2% increase in median sale prices year-over-year.

New Brunswick, New Jersey: Saw a 15% increase.

Providence, Rhode Island and Milwaukee, Wisconsin: Both experienced significant increases, with Providence at 13.6% and Milwaukee at 13.3%.

The Metros with Declining Home Prices:

Austin, Texas: Experienced a decrease of 2.3%.

Dallas, Texas: Saw a slight decrease of 4%.

Pending Home Sales Insights

Gains: Only seven metros posted gains in pending home sales from the previous year, including San Francisco, California, and Miami, Florida, which saw increases of 3.2% and 2.8%, respectively.

Losses: The majority of metros experienced declines, with significant drops in cities like Phoenix, Arizona, and Las Vegas, Nevada, where pending sales fell by 5.7% and 6.1%.

Understanding the Shifts in Market Dynamics

Real estate markets dance to their own tuned and are hyper local, with home prices and sales fluctuating from region to region. While some areas enjoy robust growth, others grapple with declines, reflecting the diverse economic and demographic forces at play. These localized trends are crucial for both homebuyers and investors to understand before making any decisions.

The Influence of Economic Policies on Regional Markets

Economic policies, including tax incentives and zoning regulations, significantly impact regional real estate markets. For instance, areas with favorable tax conditions and growth-friendly policies tend to attract more residents and investors, which boosts home prices and sales activity. Conversely, regions with restrictive policies may see a stagnation or decline in market dynamics.

Future Outlook and Strategic Considerations

As we move forward, the real estate market will continue to adapt to the ongoing economic and demographic shifts. To make informed decisions, it's crucial to stay updated on national trends and local market conditions. If you have any questions about the Texas real estate market in particular, call me! There isn’t a whole lot I love more these days than talking real estate.

Strategic Buying and Selling Tips

For Buyers: Focus on areas with strong economic growth and stable job markets. Consider the long-term potential of the area and factor in the total cost of homeownership, including taxes and insurance.

For Sellers: Emphasize the unique features of your property and community. Be realistic about pricing, especially in markets experiencing a slowdown. Timing is everything, there are ways to make sure that your sale coincides with peak buyer activity in your region.

Navigating Market Uncertainties

The real estate market is inherently unpredictable y’all. Understand the underlying factors. By being adaptable, you will be able to navigate these challenges with efficiency. The key is: BE ADAPTABLE. Whether you're a first-time homebuyer or on your tenth investment property. Staying informed is a discipline. Adjusting your strategies accordingly is the key to not loosing your shirt.

FOCUS ON PURCHASE PRICE, NOT RATES!

The real estate market is a complex and dynamic lover my friends, influenced by a world of seemingly invisible factors such as economic policies, demographic shifts, and regional disparities. It’s VERY easy to be seduced by her. The good news is, you can have a healthy relationship with your housing market. By analyzing these elements and staying informed, you can make more strategic decisions and navigate the market with greater confidence and less risk.

As we move forward, it will be interesting to see how these trends evolve and shape the future of real estate.

Remember, whether you're buying, selling, or monitoring the market, knowledge is your most valuable asset! There are no stupid questions. Drive slow, the jerk on your back bumper will go around and be no further than you are by driving like an animal. Stay informed, stay flexible, and stay proactive in your real estate endeavors.

What are your observations and experiences in your local market? I'd love to hear about them! Feel free to share your insights, whether you're noticing similar trends or experiencing something different, as they can help me to better understand the broader market dynamics.

Fields of Dreams or Nightmares: San Antonio's Stadium Proposal and Housing Crisis

The ongoing controversy surrounding a proposed baseball stadium project in San Antonio provides a compelling case study of this complex balancing act, let’s take a look at this big stadium project idea that’s shaking up The Lone Star City.

*The plan aims to create a $160 million stadium for the San Diego Padres' AA affiliate along San Pedro Creek in downtown San Antonio. The stadium is slated to be finished for opening day in April 2028.

As a Texas Realtor, my love for the Lone Star State runs deep, rooted in childhood memories of summer visits to see my dad and my stepmom. Every year, my mother would put me on a Southwest Airlines flight from Oklahoma City, and I'd eagerly anticipate those honey roasted peanuts and the cherished pilot's wings!! I can still recall the thrill of being invited into the cockpit – the special treat they would give to us divorced kids flying solo back in the day that's sadly no longer possible. These formative experiences sparked my passion for Texas, ultimately leading me to call San Antonio home. I’ve been to the Alamo more than most normal people. Spoiler alert, there is no basement.

Today, I witness San Antonio as a city on the rise y’all, with our vibrant culture, a growing economy, and a rich history that continues to captivate both residents and visitors alike. However, beneath the surface of this bustling metropolis lies a stark reality: an affordable housing crisis is gripping the Alamo City, leaving many residents struggling to keep a roof over their heads. As a realtor deeply connected to this community, I'm committed to addressing this challenge and helping my fellow Texans navigate such a complex housing market.

The city’s current situation brings to light a critical question faced by growing urban centers across the nation: how can cities prioritize economic development while also ensuring the well-being and stability of their residents, especially those most vulnerable to displacement?

The ongoing controversy surrounding a proposed baseball stadium project in San Antonio provides a compelling case study of this complex balancing act, let’s take a look at this big stadium project idea that’s shaking up The Lone Star City.

A City in Crisis: The State of Affordable Housing in San Antonio

San Antonio is currently grappling with a severe shortage of affordable housing options. The crisis affects both renters and homeowners, as evidenced by the statistic that half of all renters and a quarter of homeowners in San Antonio are considered “housing cost-burdened,” meaning that they spend at least 30% of their income on housing. The monetary strain can trigger a domino effect on people and households, compromising their capacity to cover essential expenses, set aside funds for upcoming needs, and play an active role in stimulating the local economic landscape.

Rising costs are a primary driver of the crisis we face. Coupled with the scarcity of deeply affordable housing options, this trend is pushing many residents to the brink of financial instability. Families are often forced to relocate to more affordable areas, even if it means leaving their communities and support networks behind.

A Home Run for the City? The Proposed Baseball Stadium Project

At the heart of this controversy lies a proposed $160 million baseball stadium and entertainment district project. Designated Bidders LLC, the entity that owns the San Antonio Missions baseball team, is spearheading the project, with the aim of constructing the stadium near the San Pedro Creek Culture Park.

The City Council and Bexar County Commissioners Court have already approved the project's financing plan, which includes $126 million in city bonds, $34 million from the Missions owners, and anticipated revenue from a Tax Increment Reinvestment Zone (TIRZ). The projected economic benefits, including revitalization of a previously neglected area, job creation, and the establishment of a new community asset, have fueled support for the project.

However, the project faces a significant hurdle: land acquisition. The proposed stadium requires a 2.3-acre parcel currently owned by the San Antonio Independent School District (SAISD) and used as a parking lot for Fox Tech High School.

A Strike Against Affordable Housing? The Soap Factory Apartments Controversy

A major point of contention surrounding the proposed development is the planned demolition of the Soap Factory Apartments, a 381-unit complex offering relatively affordable housing in downtown San Antonio. This decision has sparked outrage among residents, housing advocates, and community leaders.

Sarah Honeycut, a tenant of the Soap Factory Apartments, was quoted saying, "It's disheartening to know you are so easily sacrificed on the altar of the almighty dollar." The planned demolition highlights a key concern shared by many: that the pursuit of economic development is coming at the expense of those who can least afford it.

The potential displacement of hundreds of tenants raises serious concerns about exacerbating the existing affordable housing crisis and potentially increasing homelessness in San Antonio. Although relocation assistance is being offered, critics argue that the proposed $2,500 rental relocation packages are insufficient to address the long-term needs of displaced residents, especially given the already limited availability of affordable housing in the city.

SAISD Steps Up to Bat: Leveraging Land Ownership for Community Benefit

In a move that has injected further complexity into the situation, SAISD is leveraging its ownership of the necessary land parcel to push for substantial community benefits. Superintendent Jaime Aquino has outlined stringent terms for the land sale, including the following demands:

Construction of a $45 million building for the Advanced Learning Academy

A guarantee of at least 1,250 affordable housing units within SAISD boundaries

$400,000 in annual compensation for forgoing a competitive bidding process

A seat for Aquino on the TIRZ board overseeing the stadium project

A new parking garage with 250 spaces for Fox Tech High School

SAISD is emphasizing that affordable housing commitments are non-negotiable, arguing that the district has a responsibility to prioritize its educational mission and support its students and families, many of whom are struggling with the affordable housing crisis.

Deputy Superintendent Patti Salzmann stated that “[SAISD officials] believe that having the superintendent serve as a representative on the TIRZ board would protect SAISD’s long-range master plan and interests, and mitigate or avoid further declines in enrollment.” This comment highlights the district's belief that the lack of affordable housing is directly impacting its student population.

A High-Stakes Game: The Path Forward

*Estimated taxable value

The proposed baseball stadium project has ignited a heated debate in San Antonio, pitting economic development against the urgent need for affordable housing. With SAISD's bold demands on the table, the project's future hangs in the balance. Designated Bidders faces a December 9 deadline to present a counteroffer to SAISD, and the SAISD board is scheduled to vote on the proposal on December 16.

The outcome of this negotiation will have far-reaching consequences for the city. If the stadium project moves forward without adequate provisions for affordable housing, it could exacerbate the existing crisis, displacing residents and further straining an already burdened system.

On the other hand, if SAISD’s demands are met, the project could serve as a model for equitable development, demonstrating that economic growth and social responsibility can go hand in hand.

Conclusion: A Call for Comprehensive Solutions

The San Antonio Missions ballpark project presents a complex dilemma, one that reflects a broader national conversation about the challenges of balancing economic development with the need for affordable housing. SAISD's assertive stance highlights the critical role of community stakeholders in shaping development outcomes and holding decision-makers accountable.

Ultimately, the project's fate hinges on the willingness of all parties to find a solution that balances competing interests and prioritizes the needs of San Antonio residents.

The situation is one that should give us pause for thoughtful debate, and emphasizes the need for comprehensive affordable housing policies that go beyond the scope of individual development projects. San Antonio, like many other cities grappling with similar challenges, must prioritize the creation and preservation of affordable housing as a cornerstone of its urban development strategy.

Councilmember Teri Castillo's proposed housing policies, the CLT Tiered Affordability and Stay SA initiatives, offer potential solutions. These policies focus on promoting community land trusts, streamlining affordable housing production, and preserving the existing affordable housing stock.

While the powers that be don't offer details on their implementation or potential drawbacks, these policies, if effectively implemented, could represent a significant step towards addressing San Antonio's affordable housing crisis and ensuring that all residents have access to safe, stable, and affordable housing.

What will the Donald Trump presidency mean for the US housing market in 2025?

Well, folks, it happened! The Trump Train rolled right back into the White House, and now we're all wondering what this means for our real estate market. Buckle up buttercup, because we're about to take a wild ride through what the red, white, and gold-plated world of Trump's second term could mean for real estate!

Well, folks, it happened! The Trump Train rolled right back into the White House, and now we're all wondering what this means for our real estate market. Buckle up buttercup, because we're about to take a wild ride through what the red, white, and gold-plated world of Trump's second term could mean for real estate!

Remember when we thought 2020 was unpredictable? Ha! Welcome to 2025, where the housing market might just be as dramatic as that reality TV season finale you all know you DVR’d!! But don't worry, I’m here to be your personal "Art of the Deal" decoder ring.

So, what's on the landscape for the next four-years? Will we see more apartment buildings and skyscrapers sprouting like weeds? Are we in for the potential of home prices rising? Or will the market be as plateaued as Trump's famous coif?

I’ll get into all the juicy details faster than you can say "You're fired!" at a bad property listing. From potential tax shakeups to infrastructure bonanzas, it’s going to be an interesting first year back in the Oval Office for Trump. My goal is to help translate all the political talking head’s jargon into real talk for your real estate decisions. Ready to make your real estate portfolio great again? Let’s dive into it.

The Influence of Trump's Election on Mortgage Rates

One of the first questions that comes to mind with Trump's election is: How will it affect mortgage rates? Interestingly, there has been a noticeable spike in mortgage rates since mid-September, with rates climbing back to around 7%. This rise has left many puzzled about the underlying causes. A significant factor to consider is the "Trump trade." A tweet from Jim Biano, president of Bianco Research,LLC highlighted a correlation between Trump’s betting odds to win the election and the 10-year US Treasury yield. As Trump's odds increased, so did long-term interest rates, suggesting that the market anticipates higher long-term rates under Trump's presidency.

Despite Trump being a pro-business figure who has historically pressured the Federal Reserve to cut interest rates, his presidency might paradoxically be associated with higher borrowing costs. This could potentially dampen home buyer demand. The Committee for a Responsible Federal Budget estimates that US debt will rise by $7.8 trillion from 2026 to 2035, largely due to Trump's fiscal policies. Moreover, Trump's penchant for tariffs, including a proposed blanket tariff of 10-20% on all imports and even higher tariffs on goods from China, could lead to inflationary pressures, further pushing up interest rates and mortgage rates.

Trump's Potential Impact on Home Buyer Confidence and Market Dynamics

Despite the possibility of higher mortgage rates, Trump's pro-business stance could boost economic confidence and optimism about the housing market. This was evident from past data, such as the mortgage purchase application index, which saw a significant increase following Trump's election in 2016. This suggests that Trump's election could initially inspire confidence among potential home buyers, potentially stabilizing or even increasing home prices.

Slow down though! The current state of the housing market presents new challenges. Affordability metrics are at their worst, with the monthly cost of buying a home now reaching $2,800, a stark increase from $1,200 when Trump first took office. The typical home buyer now spends 40% of their income on mortgage costs, up from 24% in 2016. High mortgage rates and continuing stringent qualification criteria for mortgages might (could and would) continue to lock out many prospective buyers, raising questions about the real impact of presidential policies on the housing market's fundamental issues.

The Looming Threat of Foreclosures and Government Intervention

Looking ahead to 2025, another significant concern is the potential increase in foreclosures. Trump's less hands-on approach compared to the Biden-Harris administration could see a rollback of forbearance and loss mitigation efforts that have so far prevented many foreclosures. Data from the November ICE Mortgage Report, The nation's leading source of mortgage data and performance information, covering most of the market, indicates a worrying trend: early-stage delinquencies for 2024 vintage originations have reached 1.7%, the highest in 16 years. This spike in delinquencies, particularly among VA and FHA loans, could herald a wave of foreclosures, especially if Trump reduces government intervention in the mortgage market.

The Biden-Harris administration has taken steps to help prevent foreclosures, like automatically enrolling borrowers who've fallen behind on their payments into more affordable plans and making it tougher for lenders to take away their homes. While some folks have raised concerns about using taxpayer money to help homeowners who don't have much equity in their properties, the goal is to keep people in their homes and avoid the chaos that comes with a surge in foreclosures. If the Trump administration were to reverse these policies, it could lead to a rise in foreclosures, which could have a ripple effect on the housing market and even drive down home prices.

The Role of Fannie Mae and Freddie Mac in Trump's Housing Policy

Get ready for a potential shake-up in the world of government-backed mortgages, y’all! The Trump administration is considering privatizing Fannie Mae and Freddie Mac, two giants that support around half of all mortgages in the US. If they sell off a chunk of their government stake to private investors, it could significantly reduce the government's role in the housing market - a move that aligns with Trump's more hands-off approach to economics.

So, what does this mean for the housing market? Well, privatization could lead to higher mortgage rates since the government's backing would be reduced. This could make it tougher for buyers to afford homes and impact market stability. On the other hand, it could also lead to more competitive practices in the mortgage lending market, which could be a good thing!

*Fannie Mae financed home purchases for millions of American soldiers returning from World War II. The nation’s economy grew rapidly and the liquidity Fannie Mae provided allowed mortgage lenders to have the cash on hand to meet the demand.

Are you wondering who Fannie Mae and Freddie Mac are? They're two government-sponsored enterprises (GSEs) that play a huge role in the US housing market. Fannie Mae was created in 1938 to provide financing for homeownership, while Freddie Mac was established in 1970 to provide financing for multifamily housing. Today, they're responsible for backing around half of all mortgages in the US, which is a whopping 31 million mortgages!

The short to the long of it is: Fannie Mae and Freddie Mac buy mortgages from lenders, package them into securities, and sell them to investors. This allows lenders to make more loans and helps keep mortgage rates low. The government provides a guarantee to these securities, which makes them more attractive to investors. By privatizing these institutions, the government would be reducing its role in the housing market and allowing private investors to take on more risk.

It's worth noting that privatization is just a proposal at this point, and there are many details that still need to be worked out. But if it does happen, it could have significant implications for the housing market and the millions of Americans who rely on Fannie Mae and Freddie Mac for their mortgages.

Trump, Tariffs, and Tangles: Will the Housing Market Duck or Dive?

As we look ahead to Trump's presidency, it's clear that the broader economic landscape and the Federal Reserve's policies will have a huge impact on the housing market. And let's just say, Trump's relationship with Jerome Powell, the head of the Federal Reserve, has been a bit rocky. Trump has publicly criticized Powell and has been pushing for lower interest rates. The Fed's decisions, especially when it comes to interest rates, will play a huge role in shaping the direction of the housing market.

Trump's economic plans, which include big tax cuts and potentially aggressive tariffs on imports, could give the economy a short-term boost. But they could also lead to higher inflation and increased costs for consumers. And that's where things will get real interesting - these factors could either help or hurt our housing market, depending on how they interact with other economic factors like wage growth and employment rates.

For instance, if wages start to rise and people have more money in their pockets, they might be more likely to buy or invest in homes. On the other hand, if tariffs lead to higher prices for building materials and other goods, that will make it harder for builders to keep costs down and for buyers to afford homes. So, it's a complex picture my friends. Which will come first? The chicken or the egg? Will wages go up? Will building get cheaper? Unfortunately, we'll just have to live through these factors playing out to get a true sense of what the future holds for our housing market under Trump's presidency.

What’s Good in the Hood? The Importance of Being Aware of Local Market Fundamentals

While national policies and economic trends are important, the most critical factors for home buyers and investors are often local market conditions. Understanding the fundamentals of your local housing market, such as cap rates and historical price trends, is critical for making eyes wide open decisions. Cap rates, for example, provide valuable insight into the potential return on investment in different regions and can indicate whether it's a favorable time to buy or invest in a particular area…so don’t ignore them!

When it comes to investing in a single-family rental home in Texas November 2024, the right capitalization rate (cap rate) depends on a few key factors. First and foremost, there's your personal risk tolerance. Are you looking for a steady income stream with minimal risk, or are you willing to take on more risk in pursuit of potential growth? If you're looking for stability, a cap rate of 4-5% might be the way to go. But if you're willing to take on more risk, a cap rate of 8-12% could be more appealing.

Some investors, particularly those with a more aggressive approach, tend to shy away from properties with cap rates below 8%. In fact, some may even require double-digit returns. However, it's essential to consider the diverse range of factors influencing investment decisions. A cap rate of around 6% can be considered exceptionally attractive in the market you are buying in! In Texas, for example, many homeowners have low mortgage rates, which can limit the supply of homes available for purchase. This can impact the cap rate you're looking for.

Finally, the property itself is a major consideration. What's the property's location, condition, and potential for renovation or redevelopment? These factors can all influence the cap rate you're looking for.

By considering these factors, you can get a better sense of what cap rate is right for you and your investment goals.

Will 2025 Be Better?

As we head into the new year, it's clear that the housing market is in ongoing trouble, and we're looking at a complex web of factors that will shape the market's direction. From new government policies (or lack there of) to economic strategies and the actions of the Federal Reserve, there’s a dizzying array of things to keep track of.

But here's the thing: while it's important to stay informed about national trends, it's your local market that will ultimately make or break your real estate decisions. This is not a new rule, it has always been the case. Whether you're a home buyer or investor, understanding what's happening in your own backyard is crucial. Too many get suckered into the shiny sales pitch before we do our homework.

So, what does this mean for your action plan? It means staying informed about both national trends and local conditions keeping an eye on the big picture, but don't lose sight of what's happening in your own community! Pay attention to your city government. Go to those city council meetings! Be a sponge! By doing so, you'll be better equipped to navigate and possibly predict the chaos of the real estate market in 2025 and beyond.

In the end, while geeking out on macroeconomic and political climates is certainly an important activity, it's really understanding local housing market dynamics that will ultimately hold the key to shooting for success in real estate investment and homeownership. Stay informed, stay local, and get ready to make some moves in the 2025!

AGAIN REMEMBER KIDS: ALL REAL ESTATE IS LOCAL, even if the White House looks more like Mar-a-Lago these days. Do you know what else is local? You are! It’s impossible to predict what the housing market under Trump will look like this time around. What you can know is that neighborhood and financial knowledge is POWER.

And don’t forget to get your buyer’s agency with a REALtor in your neck of the woods. If you’re in Texas…I’ll help you navigate your neighborhood market, whether you're in a blue county, a red county, or somewhere in the purple haze in-between!

Why Are Mortgage Rates Rising? Here’s What You Need to Know!

If you've been following the recent fluctuations in mortgage rates and wondering how they might impact your home-buying journey, you're not alone. I want to share a story that illustrates the importance of acting decisively in this market.

If you've been following the recent fluctuations in mortgage rates and wondering how they might impact your home-buying journey, you're not alone. I want to share a story that illustrates the importance of acting decisively in this market.

Recently, I had a client who was eager to rightsize into a new home in Canyon Lake, TX. We spent this entire year (I kid you not) walking properties and hunting for his vision, when we FINALLY found something he was really excited about. However, he held off on making an offer because he was convinced that when the Federal Reserve dropped interest rates last month, mortgage rates would surely follow suit. Now, I’m a closeted economics nerd and I follow a lot of the Academic Economists on the University of YouTube, and I told him that the word on the street is that rates will probably go up before Christmas.

Unfortunately, he hesitated just a little too long and he lost out on that property. The waiting has led us to a point where we might need to spend several more months searching for a comparable property. This experience is a reminder that while it’s natural to want the best deal, timing is crucial in real estate. Let’s dive into what these changing rates mean for you and how to navigate the current landscape with a little less wear and tear on our internal hope heart regulators, y’all.

Source: Reventure App

What’s Happening with Mortgage Rates?

You might think mortgage rates would’ve droped after the Federal Reserve recently cut interest rates. Instead, they’re climbing! Right now, the average rate for a 30-year mortgage is around 6.4%, which is more than a quarter-point higher than just a couple of weeks ago. So, what’s going on?

The Fed’s Role: The Federal Reserve influences mortgage rates, but they don’t set them directly. Instead, mortgage rates often follow the yield on 10-year Treasury bonds. Recently, that yield has gone up because investors think the Fed might be more cautious about cutting rates again.

Lender Costs: When you get a mortgage, lenders add on their own fees to cover costs and make a profit. Your specific rate will also depend on your credit score and the type of loan you choose.

Comparative Rates: Even with the recent rise, mortgage rates are still lower than they were last year. This has allowed many homeowners to refinance, meaning they can switch to a new loan with a lower interest rate, saving them money each month.

What’s Next for Mortgage Rates?

Predicting where mortgage rates will go is tricky because they depend on various factors. Experts generally agree that we probably won’t see super-low rates like we did a few years ago. For example, back in 2019, rates were between 3.75% and 4.5%. Now, they might stabilize around 6% by the end of this year.

According to Lawrence Yun, an economist at the National Association of Realtors, we might be looking at a “new normal” where rates hover around 6%. He believes that seeing rates drop to 3% or 4% again is unlikely.

Should You Buy a House Now or Wait?

The decision to buy a house feels kind of comparable with deciding if it’s a good time (or not) to have a baby…is there ever the perfect time? With rates changing, you might be wondering whether to jump into the housing market or hold off. Here’s the deal: experts suggest it’s better not to wait for rates to drop for a couple of reasons:

Refinancing Possibility: If you buy now and rates go down later, you can refinance your mortgage to get a better deal. But if you wait and rates go up, you could end up paying more.

Home Prices Rise: Home prices usually increase over time. Waiting could mean you end up paying more for a home down the line. There has been a lot of press lately about how home prices are dropping, but remember that the housing market in one part of the country can behave completely differently 500 miles away. This is why it’s important to find a Realtor you trust in the market you are buying in, they will have their finger on the pulse of your local market.

Interestingly, even people who bought homes when rates were super high (like 15% in the 1980s) often ended up doing well because home values increased over time.

What’s Going On in the Housing Market?

Source: EPB Research

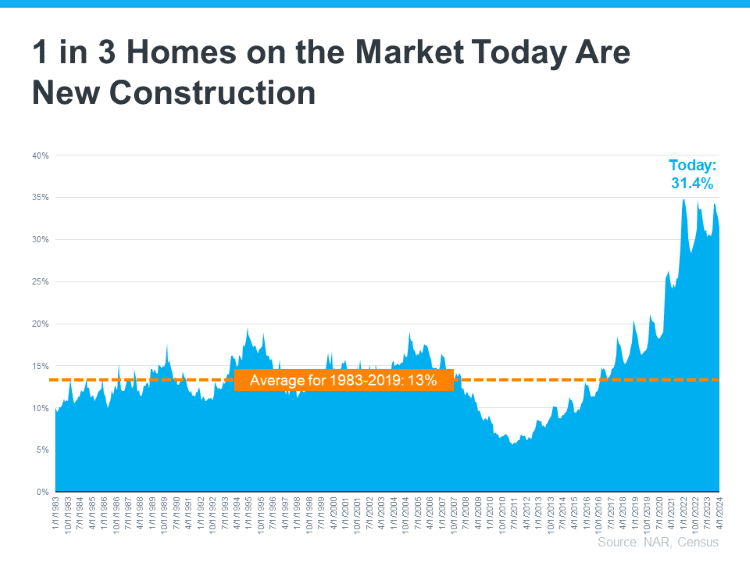

Here’s a silver lining: that inventory problem we have all been hearing about since the beginning of Covid? Well, most major markets are back to pre-pandemic inventory levels! And, according to RE/MAX, the nation wide number of homes for sale went up by 6.4% from last month and is 33.6% higher than last year. Plus, houses are sitting on the market A LOT longer, which in theory means there’s less competition for buyers.

But, here’s the catch: home prices are still pretty high. Since early 2020, the median home price has shot up about 50%. As of August, the median price was around $416,700, which is about 3% more than last year.

Seasonal Trends

The housing market usually gets busier in the spring and summer, slowing down in the fall and winter. This might mean that fall could be a good time to shop, as there might be less competition and more room to negotiate on prices. Sellers are starting to realize that they may have to do significant price cuts to motivate buyers to start making offers again.

Experts predict home sales could rise by 10% next year, but a real bounce-back might not happen until spring.

Still On The Fence? Take Charge of Your Future!

So, what does all this mean for you? If you're thinking about buying a home one day, it’s important to stay informed and ready to act! While rising mortgage rates might sound scary, understanding the situation can help you make smart choices.

If you’re ready to learn more about buying a home or just want to chat about your options, reach out! Let’s navigate this exciting journey together!

#RealEstate #MortgageRates #HomeBuying #FutureHomeowner #InvestInYourFuture #HousingMarket #FinancialLiteracy

Active Listings Comal County

〰️

Active Listings Comal County 〰️

The Presidential Election: Does it, Will it, Can it..affect the housing market?

With the presidential election just around the corner, it's no surprise that housing affordability has taken center stage. Both major party candidates have addressed the issue on the campaign trail, and it's clear that young voters are prioritizing affordable housing above all else.

As a Realtor and advocate for affordable housing, there is one thing that I wake up every morning thinking about. No, it’s not how much I wish someone would make coffee for me…that’s my second thought. It’s, “How can I structure my day and negotiate my deals better today to get my buyers into a house this month?” Not because I get off on the thrill of the deal, it’s because my buyers these days are EXHAUSTED, tapped out, pushed to the edge of what is humanly reasonable, twisting themselves into financial contortions that would make any Cirq du Soleil acrobat jealous of their flexibility. I have moral rage surrounding the issue of affordability.

On top of the burden of home buying affordability and predatory mega builders today, the powers that be keep telling us that “The economy is fine stupid, it’s totally normal that you are working three jobs to buy this house!”…we are in an election year. Now y’all know elections DON’T EVER do anything to thread the needle of solving any housing crisis, but they do affect everything else on a deeply psychological level when it comes to how we do business and thrive (or not) in our daily lives. Folks generally take a ‘wait and see what happens’ approach the year leading up to an election to make big decisions. Affordability in the housing market, well that’s its own animal.

Source: CNBC.com

The Data Explanation: “Too Much, too many, no number! I’ll buy it tomorrow maybe.”

As we all know, decisions in residential real estate can be overwhelming, especially when it comes to navigating the complex world of market data and how real estate professionals like myself valuate houses. With the presidential election just around the corner, it's no surprise that housing affordability has taken center stage. Both major party candidates have addressed the issue on the campaign trail, and it's clear that young voters are prioritizing affordable housing above all else. As they should.

Source: CNBC.com

So, what's the deal with the housing shortage?

Based on “The Numbers” it's clear that a lack of supply has been the primary driver of high home prices and worsening affordability in the US. But here's the thing: the estimates of the housing shortfall vary wildly and there is significant lag time when collecting data on a national scale, ranging from 1.5 million to 5.5 million units. That's a big range. Housing markets can and do behave drastically different when looking at averages depending on where you live. The jury is out on how much we can rely on the humans who interpret that data to tell us what might happen next, but the takeaway is clear: we absolutely need more housing to meet demand nation wide.

Source: CNBC.com

Now, let's talk about the different approaches to calculating the housing shortfall. The National Association of Home Builders and Freddie Mac rely on assumptions about long-term housing vacancy rates, while Moody's Analytics takes into account pent-up household formations. Up for Growth, a national housing member network, nets out second and vacation homes, as well as uninhabitable units, leading to their higher estimate. And the National Association of Realtors takes a different approach by comparing current levels of housing construction with historic averages.

So, what does this mean for us in New Braunfels? It means that we need to focus on increasing the supply of housing to meet the demand. And that's exactly what the Harris-Waltz campaign is proposing: incentives to promote new housing construction, including tax incentives for building starter homes, recommendations for streamlining permitting processes, and initiatives to stop predatory investing (my personal favorite thing to lament over) in single-family homes. Their goal is to facilitate the production of 3 million housing units over four years.

One thing that I am noticing in our market is the shift in the square footage size in new home builds in Central Texas. Gone are the days of massive, 5,000-square-foot mansions and good luck trying to sell one! Instead, builders are now constructing homes with smaller square footage, often in the range of 2,000-3,000 square feet. And I think this is a game-changer for families who are looking for a unique solution to the affordability crisis. Why not consider buying one of these smaller homes and converting it into a "multi-generational legacy home"? With a little creativity and some smart design, you could easily add an in-law suite or a separate living space for your adult children. And with builders now purposefully designing homes with layouts that make it easy to add or subtract bathrooms, walls, and kitchens, the possibilities are endless.

As for the Trump-Vance campaign, they've suggested reducing government regulation and curbing immigration to expand the housing supply. While I understand the desire to reduce regulation, I'm not convinced that this approach will solve the problem. In fact, it might even exacerbate the issue by limiting the number of people who can contribute to the housing market.

Action Plan: Where to Start?

It's clear that we need a multifaceted approach to building and sustaining affordable housing that encourages new construction, motivates homeowners to sell their homes, and reduces regulation. We need to incentivize local and state governments to reduce the costs associated with homebuilding, and that won’t happen on its own y’all! Get involved in your communities and vote, it’s the ONLY way. It may seem like your votes don’t matter sometimes..but they DO!

Speaking of mega mansions that would be GREAT to convert into your familie’s "Multigenerational Legacy Home”. Seriously! Think about it:

As your REALltor and Advocate for affordable housing, I'm committed to staying on top of the latest developments and working with our local leaders to find solutions that work for our community. Let's work together to make New Braunfels a place where everyone can afford to call home y’all!

"There have been few things in my life which have had a more genial effect on my mind than the possession of a piece of land." —Harriet Martineau

"There have been few things in my life which have had a more genial effect on my mind than the possession of a piece of land." —Harriet Martineau

Texas law requires all license holders to provide the Information About Brokerage Services to Prospective clients

⭐️⭐️⭐️⭐️⭐️ TESTIMONIALS ⭐️⭐️⭐️⭐️⭐️