Housing Outlook 2025: How migration is dividing the housing market in two

It's that time of year again when our friends at Altos Research has put together their 2025 Forecast. Today, I'm diving into that report and, while I'm at it, the complexities of the U.S. housing market as we approach the end of 2024 and look ahead to 2025 and then we'll take a look at what is happening in my South Texas market. Do you have reality fatigue? I sure do. I'm here to unpack the latest data and trends for you.

The Current State of the Housing Market

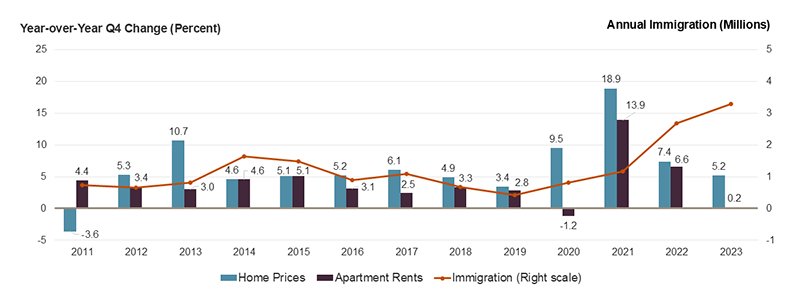

As we wrap up 2024, it's clear that the national housing market is anything but uniform. Different regions are experiencing vastly different realities, in politics and in our housing market. Nationally, home prices are set to finish the year with a 5% increase over the previous year. This increase comes despite a historically low number of home sales and a 27% rise in unsold homes on the market compared to last year. This discrepancy highlights the unique and bifurcated nature of the market across the country.

Regional Differences

The U.S. housing market currently exhibits a clear divide:

The Sunbelt: Regions like Austin, Tampa, and Phoenix have seen a significant increase in the number of homes for sale, reaching levels not seen in many years.

The Rustbelt: In contrast, areas like Chicago and Boston have barely seen any increase in unsold homes, remaining tight even compared to pandemic levels.

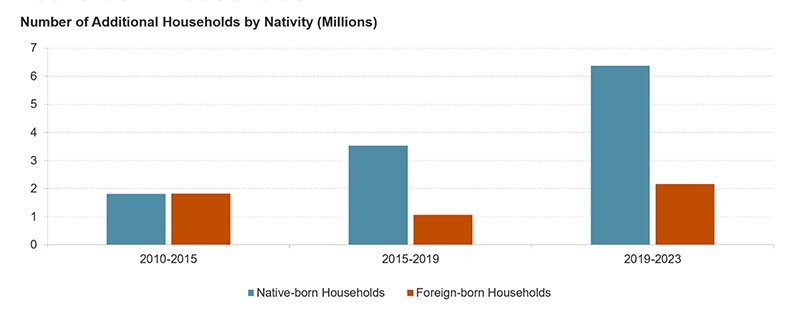

This division is primarily driven by migration patterns within the country, not immigration. Historically, there has been a significant movement of Americans from cities like Chicago and New York to sunnier locales in the Sun Belt, such as Arizona, Texas, and Florida. However, this migration has stalled in the last two years, particularly in 2024.

Understanding Migration Trends and Their Impact

The sudden halt in migration has sent shockwaves through the housing market, revealing a complex web of consequences that we have never seen before. In the South, where the once-thundering engines of relocation have sputtered to a halt, a glut of homes now lingers, threatening to upend the delicate balance of supply and demand.

Meanwhile, in the Northeast, the scarcity of inventory continues to fuel a fierce competition among buyers, leaving many to wonder if the dream of homeownership remains within reach and if they should even bother trying anymore until things loosen up. As we navigate this new landscape, one thing is clear: the migration trends of today will shape the housing market of tomorrow.

Economic Factors Influencing Migration

Several economic factors have contributed to this migration freeze:

High Costs: The cost of moving, coupled with expensive housing and mortgage rates, has deterred so many from relocating.

Job Scarcity: Despite low unemployment rates, the scarcity of jobs in desired locations adds another layer of complexity. (We all are tired of hearing that unemployment number…I know. Y’all need to be paying close attention to this. In my own circles I have many friends who have been laid off this past year and struggling to find work, including myself.)

Insurance and Climate Concerns: Rising insurance costs and the risk of climate-related disasters have also made moving to certain Southern markets less appealing. Water is a thing, y’all.

*As we move into 2025, the folks at Altos Research anticipate a slight loosening of this migration freeze, which could help increase inventory in the North and tighten it slightly in the South. But, I have my doubts about that.

Inventory Trends and Predictions for 2025

As of the last week of November 2024, there were 77,000 single-family homes on the market, marking a 27% increase in unsold homes compared to the previous year. This aligns with our expectations for where inventory levels would end the year. Interestingly, we are now only 18% below the pre-pandemic levels of November 2019, suggesting a gradual return to “normalcy” if not out right over supply in some markets.

Future Inventory Projections

Looking ahead to 2025, the inventory of unsold homes is expected to continue rising, though not as dramatically as in 2024. The pace of this increase will largely depend on broader macroeconomic factors and how the suits in the mortgage markets behave. If conditions align, we could see inventory levels approaching those seen before the pandemic by the end of next year.

Seasonal Variations and Market Adjustments

As the holiday season is upon us, the natural ebb and flow of the housing market is already taking effect. With the Thanksgiving holiday falling late this year, inventory levels are expected to dip below 700,000. This seasonal trend is likely to have a more pronounced impact on December's inventory levels compared to previous years. While some may dismiss the seasonal fluctuations, I find it frustrating that many people overlook the data and attribute the slowdown to the seasonal changes, without considering the underlying market dynamics.

Regional Market Dynamics: North vs. South

The bifurcation of the market into Northern and Southern segments presents distinct challenges and opportunities:

Dallas: The increase in available homes is notable, with more homes for sale now than at any time in the last decade.

Chicago: Conversely, there are 60% fewer homes for sale now compared to past averages, illustrating the tight market conditions.

This gap is mainly due to the slowdown in migration from cities like Chicago to Dallas. This trend has been affected by increasing moving costs and a host of economic uncertainties as we enter a new presidential administration.

Anticipated Changes in 2025

While the migration freeze is expected to continue into early 2025, there may be slight movements as conditions evolve. These shifts will be crucial for rebalancing the supply in Northern markets and possibly tightening the Southern markets slightly.

Deep Dive into 78130

As both a resident and an expert in Comal County real estate, I've witnessed firsthand the fascinating market dynamics over the past four years. 78130 is currently experiencing a palpable shift towards a buyer's market, with a predicted moderate decline in home prices over the next 12 months. I’m just going to call it a long needed market correction, even though pretty much everyone I know is in complete denial about that (...it’s just the holidays it’s always this bad…said every sales team lead and armchair housing market expert ever).

Although the potential for growth over a long period is still good, there are a few reasons why the outlook for the near future is not very positive. These include negative recent appreciation, elevated inventory levels, increased seller price cuts, and relatively high mortgage rates. Despite this, there is still strong demographic growth and high wealth levels in the area offer us a more positive counterpoint for the long term.

In a nutshell:

Short-Term Forecast (6-12 Months):

Price Down: Reventure App predicts a moderate decline in home prices, assigning a Home Price Momentum score of 38/100.

Declining Market Indicators: Four out of five key indicators point towards a declining market, including:

Negative Recent Appreciation: Home values declined by 4.4% year-over-year, with the typical home value dropping from $334,527 to $319,791.

Elevated Inventory Levels: The number of homes for sale is 28.7% higher than the seven-year average, signaling potential oversupply.

Increased Price Cuts: 26.3% of sellers reduced their asking price in November 2024, significantly above the historical average of 22.2%.

High Mortgage Rates: The current 30-year fixed mortgage rate of 6.43% sits above the five-year average, potentially dampening buyer demand.

Positive Indicator: Days on Market is currently 18.5% below the long-term average, suggesting continued buyer interest.

Long-Term Growth Forecast (10 Years):

Above Average Growth: Reventure App projects strong long-term growth, with a Long-Term Growth score of 65/100.

Growth Drivers:High Wealth/Income: The median household income is $87,936, and the poverty rate is a low 6.1%, indicating strong economic fundamentals.

Robust Demographic Growth: The area witnessed a 30.2% population increase in the last five years.

Challenges:Below Average Affordability: The Home Value/Income Ratio of 3.64x is near the US average but suggests affordability challenges for some buyers.

Overvaluation: Current home prices are estimated to be 3.3% overvalued compared to long-term norms.

For My Investor’s Outlook:

Average Returns: Reventure App assigns an Investor Forecast score of 53/100, indicating returns similar to the US average over the next decade.

Positive Factors:Strong demographic growth supports long-term appreciation potential.

A 3.3% overvaluation suggests potential for future price appreciation.

Negative Factors:Below average historical appreciation (NaN% over the last 15 years).

Poor rent growth (-0.42% from 2019-2024).

A low cap rate of 4.3% indicates limited cash flow potential for investors, ranking in the 0th Percentile of all housing markets in America in terms of cash low yield.

Note: The "NaN%" figures in the reports indicate missing data, potentially impacting the accuracy of certain long-term projections. Further investigation is required to determine the missing data's significance, y’all.

A note for my investors: The housing market in 78130 has been experiencing a stall out my friends for quite some time now, with short-term price declines anticipated. Although this will create opportunities for my buyers, my investor buyers should proceed cautiously due to limited or down right non existent cash flow prospects. However, the long-term outlook remains positive in my opinion, fueled by strong demographic and economic fundamentals. However, affordability and overvaluation concerns could impact future growth my friends. One way I encourage folks who already live here to raise their voice and combat future appraisal overshoots is to protest your property taxes yearly!!!

Looking Forward: Hope?

I’m not going to sugar coat it my friends, as we approach 2025 the U.S. housing market remains a multifaceted and polarized environment. There's no denying the gravity and the complexity of the situation. The pronounced disparity between Southern and Northern markets, largely influenced by evolving migration trends, does not bode well for next year. Most professionals won’t tell you this, but I will.

The current migration freeze, influenced by high costs, job scarcity, and climate concerns, has created an oversupply in previously popular Southern destinations while maintaining tight conditions in Northern markets. However, I can’t be totally cynical as we enter 2025. There is potential for a slight thawing of this freeze, which could begin to rebalance these regional disparities. I mean, quite literally anything could happen.

The inventory trends projected for 2025 suggest a gradual return to pre-pandemic levels, albeit with continued regional variations to be expected because the housing market is so hyper local. I’m putting out the positive vibe for potential normalization that could bring relief to some markets. However the sad truth about the housing market is that it’s not possible for every market across the us to be simultaneously winning, and there will be significant challenges to offset the wins of others.

Ultimately, the housing market's future will be shaped by a combination of economic factors, migration trends, and regional dynamics. As we move forward, it will be crucial for buyers, sellers, and investors to stay informed about these nuanced market conditions and adapt their strategies accordingly. What’s my motto kids? Adapt and survive.

The bifurcated nature of the current market serves as a reminder that in real estate, location matters more than ever. As we navigate through 2025 and beyond, understanding and responding to these regional differences will be key to making informed decisions in an increasingly complex housing landscape. If you or anyone else you know need help, advise, or a shoulder to take the weight of your uncertainty…I got your back.

Don’t like reading? Greg and Sarah have your back! Here’s the Deep Dive.