U.S. Housing Market: Truths, Trends, and Regional Disparities

The U.S. housing market, often the misunderstood ADHD kid at the party, dances to a tune of misalignment rather than a simple shortage of structures my friends, revealing a complex interplay between market expectations and economic realities. According to the US Census Bureau’s Household Survey Data, a staggering 10% of the nation’s housing stock—around 15 million homes—sitting empty, the tale of scarcity begins to unravel like an old sweater!

The Housing Market's Hidden Truths

The U.S. housing market, often the misunderstood ADHD kid at the party, dances to a tune of misalignment rather than a simple shortage of structures my friends, revealing a complex interplay between market expectations and economic realities. According to the US Census Bureau’s Household Survey Data, a staggering 10% of the nation’s housing stock—around 15 million homes—sitting empty, the tale of scarcity begins to unravel like an old sweater!

Driving through neighborhoods, one can spot a plethora of unoccupied and unfinished properties, especially the MANY sprawling luxury homes built for tv aspirations. As a Texas Real Estate Agent , I pay relentless attention to today’s tricky landscape (because I care about you and want to save you the stress), particularly amidst the swirling winds of U.S. politics right now. My mission is to illuminate and simplify the path for you, whether you’re a first-time homebuyer, one of my seasoned investors, or simply a curious observer of real estate trends (I know there are some nerds like me out there that love trend watching), providing a nuanced perspective on what to consider as you ponder the prospect of homeownership in 2025. So, settle in my little housing munchkins—we’re about to delve into the complexities of today’s housing gauntlet!

The Pricing Paradox

One of the most glaring issues in the current housing market is the pricing strategy adopted by many sellers. I am going to sound harsh, but it’s good for folks to take in: There is a widespread delusion regarding the potential selling price of homes, with many owners still setting unrealistic price tags that have absolutely no alignment with what most buyers can afford today. This mis-pricing is particularly pronounced in the luxury home segment, where (completely devoid from rationality) the construction of opulent 4000sq ft “homesteads” behind developed suburban gates and high-spec residences continues despite a clear mismatch with market demand.

Overall, the housing market could be described as ‘frozen’ (you’re welcome:). A better word for it might be a type of stagnation, however the economists in suits will completely gloss over this idea and change the subject. This doesn't mean that nothing is happening, but rather that key factors are suppressing both supply and demand, leading to a unique set of challenges and opportunities. This stagnation is driven by a combination of:

Homeowners' reluctance to sell

High interest rates

Affordability issues

Potential policy changes

Why Aren't People Selling? The "Lock-In" Effect

One of the most significant factors contributing to the current market conditions is that many homeowners are choosing to stay put. According to a recent Redfin survey, 34% of U.S. homeowners say they will never sell their homes, and another 27% wouldn't consider selling for at least 10 years!! Ya’ll, that is significant. This reluctance stems from several reasons:

Paid-Off Homes: Nearly two in five (39%) homeowners who don’t plan to sell anytime soon say it’s because their home is almost or completely paid off. Owning a home free and clear, only paying for property taxes and HOA fees, is a powerful incentive to stay put.

For The Love of Home: Almost as many respondents (37%) said they’re not selling because they simply like their home and have no reason to move. Sometimes, the emotional attachment and comfort of a familiar space outweigh any potential financial gains from selling.

High Replacement Costs: Nearly one-third (30%) of respondents are staying in their current home because today’s home prices are too high With 31% of Gen Z not in a hurry (or able) to get out of their parent’s houses. With home prices having risen significantly since before the pandemic, many homeowners are hesitant to jump back into the market as buyers.

Low Mortgage Rate "Golden Handcuffs": A significant 18% don’t want to give up their low mortgage rate. With more than 85% of U.S. homeowners with mortgages having an interest rate below 6%, the thought of taking on a new mortgage at current rates is a major deterrent.

Wealth Effect: The wealth effect is when people spend more because the value of their assets, like stocks or real estate, increases. This perceived increase in wealth makes them feel more financially secure, boosting consumption. On the flip side, if asset values drop, spending may decrease. The wealth effect from borrowers with significant home equity and/or equity market growth should maintain positive home price growth, though at a much more subdued pace than the Covid Housing Boom.

This reluctance to sell has resulted in a historically low housing turnover rate. According to Redfin in the first eight months of 2024, just 25 out of every 1,000 U.S. homes changed hands, the lowest turnover rate in decades. This limited supply naturally impacts the entire market dynamic.

3% Interest Rates: The Lover That Has Moved On

The sad realty is, if you’re waiting for interest rates to go under 5% ever again..you’ll be holding your breath for a long while. Sometimes it’s best to accept you’ve been broken up with and cut your losses. The current stagnation is closely married to elevated interest rates.

Suppressed Demand: High interest rates increase the cost of borrowing, making it more expensive for potential buyers to enter the market. This directly impacts affordability and reduces the pool of qualified buyers.

Discouraged Sales: As mentioned earlier, many existing homeowners are locked into low mortgage rates. The prospect of selling their home and then having to secure a new mortgage at a significantly higher rate discourages them from listing their properties.

Modest (and I mean that’s an understatement if I ever heard one) Relief Expected: J.P. Morgan Research anticipates that mortgage rates will ease only slightly to 6.7% by the end of 2025. This suggests that the "lock-in" effect and its impact on supply will likely persist.

Basis Points: Over 80% of borrowers have mortgage rates that are at least 1% higher than current market rates (100 basis points equals 1%). This makes refinancing or selling unattractive for them, leading to a reduced supply of homes on the market.

The housing market's dynamics are further complicated by demographic factors and economic interventions. Older individuals, having had more time to accumulate assets, are generally wealthier and continue to hold a significant portion of the market. However, the broader market participation necessary for a healthy housing ecosystem is lacking. This scenario is mirrored in the job market, where growth is predominantly seen in sectors like healthcare and government, which does not bode well for economic diversity, at all.

There is are so many professionals in the industry that are taking the ‘if I ignore it maybe people will stop asking, and critics often label concerns about these trends as pessimistic, yet they very much align with classic recessionary indicators. The ongoing economic handholding, such as interventions that delay the inevitable adjustments, only adds complexity to the market. This situation disproportionately affects younger people and the middle class, who find themselves increasingly sidelined in the current economic landscape.

An Alarming Rise in Delinquencies

A recent mortgage industry conference highlighted a worrying trend: the rise in 90+ day delinquencies. This is very concerning given the extensive financial relief measures that have been implemented, which should have theoretically alleviated such pressures. The lack of transparency in reporting these delinquencies suggests a deeper systemic issue that I expect could have long-term repercussions for the housing market.

The Student Loan Debacle

Adding to the economic train wreck, the impending resumption of student loan repayments is set to reveal further distress within the consumer base. Issues with loan servicing and the tracking of these loans hint at potential chaos as borrowers attempt to navigate their repayment obligations amidst poor administrative handling.

Regional Vulnerabilities Beginning To Trend

It's essential to recognize that the U.S. housing market is not a monolith. Regional disparities play a significant role in shaping local market conditions.

Vulnerable Cities: Cities like Denver, Austin, and Nashville, with high concentrations of younger renters, are particularly vulnerable to economic shifts due to the economic sensitivity of renters who have lower incomes and wealth accumulation.

Manhattan's Unique Challenges: Manhattan faces challenges due to rent control laws that have led landlords to withhold apartments from the market, contributing to high vacancy rates and reliance on rental income.

The Northeast's Struggles: The Northeastern United States, especially New York, faces demographic shifts and economic fragility due to high costs of living and reliance on family financial support.

Midwest Affordability: Cities like Cleveland and Cincinnati in the Midwest generally offer more affordable housing markets compared to coastal cities.

The "Hidden Vacancy" Problem

While there's much talk about a housing shortage, it's important to acknowledge that there is a "hidden vacancy" problem. This hidden truth reveals that approximately 10% of the U.S. housing stock, equating to about 15 million homes, is sitting vacant.

This suggests a mismatch between the types of housing available and the needs/affordability of potential buyers. Vacancy rates indicate that there are enough homes, but they may not be the right type, in the ideal location, or at an affordable price point.

The Northeast's Decline

The Northeastern United States, particularly New York, has experienced significant demographic shifts that have negatively impacted the housing market. Many residents, especially younger ones, rely on financial support from family to afford the high cost of living. This dependency creates a fragile economic environment that is highly susceptible to downturns. For instance, during economic hardships, such as job losses, many residents may choose to leave expensive cities like Manhattan, leading to increased vacancies and a destabilized market.

Legislative Impacts and Market Speculation

In 2018, New York implemented stringent rent control laws, which inadvertently led landlords to withhold apartments from the market, hoping for a legislative reversal. This decision has contributed to the high vacancy rates observed in Manhattan. Additionally, the city's status as a sanctuary city has led to unique uses of hotel spaces, further complicating the housing and rental markets. These factors, combined with high investor activity and speculative behavior, underscore the multifaceted challenges facing the housing market in the Northeast.

The Midwest's Emerging Trends

Turning our attention to the Midwest, we observe a different set of dynamics. Cities like Cleveland and Cincinnati are noted for their more affordable housing markets compared to coastal cities. However, even in these areas, the affordability is relative and is becoming increasingly strained.

Investor Influence and Market Corrections

The Midwest has attracted significant investor interest, particularly in affordable housing sectors. However, this influx of investment has not necessarily led to a balanced market. Instead, it has often resulted in heightened market activity without a corresponding increase in genuine homeowner occupancy, leading to potential bubbles and unsustainable price inflations.

Seasonal and Demographic Shifts

The seasonal nature of the housing market also plays a crucial role, especially in areas like the Northeast, where harsh winters can deter home listings and sales. As the weather warms, there may be an uptick in market activity, but this is often tempered by the underlying economic and demographic challenges that continue to plague the region.

The Trump Administration's Potential Impact

As we move further into 2025, the policies of the Trump administration could significantly shape the housing market. While it is possible to loose our minds and try to predict the future with certainty, here are some potential impacts based on current proposals and historical trends:

Increasing Supply:

Streamlining zoning approval processes and making federal land available for new housing construction projects could increase the housing supply. However, these changes would primarily need to be addressed at a local level.

Decreasing Supply:

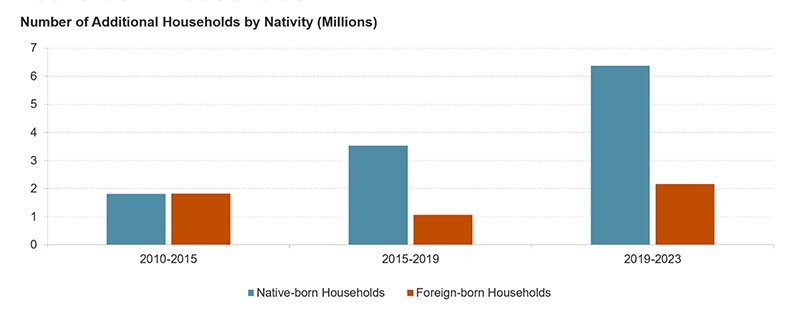

Restricting immigration could negatively impact the construction labor force, potentially exacerbating the affordable housing shortage. Approximately 30% of construction workers are immigrants.

Trump has generally opposed multifamily developments in predominantly single-family neighborhoods and has expressed intentions to prevent low-income housing developments in suburban areas.

Increasing Costs:

Privatizing government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac could lead to higher mortgage rates, further dampening demand.

Several of Trump’s proposals could lead to rising inflation y'‘all, which is very likely to result in higher mortgage rates and further reduce housing demand.

Navigating the 2025 Market: Advice for My Buyers

Y’all the current housing market landscape is really tricky, so what should potential homebuyers do? Here's my motherly advice:

Assess Your Financial Situation Realistically:

Get pre-approved for a mortgage: Understand how much you can realistically borrow and what your monthly payments will look like at current interest rates.

Factor in all costs: Don't just focus on the mortgage payment. Consider property taxes, insurance, HOA fees, and potential maintenance costs.

Be honest about your budget: Don't stretch yourself too thin. It's better to buy a home you can comfortably afford than to be house-poor.

Consider the Long Term:

Think about your future plans: How long do you plan to stay in the home? If you're only planning to stay for a few years, the transaction costs of buying and selling might outweigh the benefits.

Factor in potential interest rate changes: While rates are expected to remain elevated, there's always the possibility of fluctuations. Can you afford the payments if rates rise further?

Be Patient and Persistent:

Don't rush into a decision: Take your time to find the right property that meets your needs and budget.

Work with a knowledgeable agent: A good real estate agent can help you navigate the complexities of the market, find hidden opportunities, and negotiate the best possible deal.

Consider different locations: Be open to exploring different neighborhoods or even cities. You might find more affordable options in less popular areas.

Look Beyond the Headlines!!!!!!:

Do your own research: Don't rely solely on media reports. Dive into local market data, talk to local experts, and form your own informed opinion.

Understand the regional nuances: The national housing market is a collection of local markets. What's happening in Texas might be very different from what's happening in California.

Acknowledge Trump's Policy Changes:

Anticipate policy changes: The new administration could bring policy changes that have complex and conflicting effects on the housing market.

Factor in potential mortgage rates: Privatizing GSEs like Fannie Mae and Freddie Mac could lead to higher mortgage rates, which would further dampen demand.

The U.S. housing market in 2025 will continue to be a complex and uncertain landscape my friends. All of the factors combined, including homeowners' reluctance to sell, high interest rates, affordability issues, and potential policy shifts, will keep a lot of people hand tied for a little while. As a Texas real estate agent, I encourage you to stay informed, do your research, and seek expert advice. By understanding the current trends and challenges, you can make informed decisions and navigate the market with confidence.

Stay stong out there, be kind, and stay engaged!

Housing Outlook 2025: How migration is dividing the housing market in two

It's that time of year again when our friends at Altos Research has put together their 2025 Forecast. Today, I'm diving into that report and, while I'm at it, the complexities of the U.S. housing market as we approach the end of 2024 and look ahead to 2025 and then we'll take a look at what is happening in my South Texas market. Do you have reality fatigue? I sure do. I'm here to unpack the latest data and trends for you.

It's that time of year again when our friends at Altos Research has put together their 2025 Forecast. Today, I'm diving into that report and, while I'm at it, the complexities of the U.S. housing market as we approach the end of 2024 and look ahead to 2025 and then we'll take a look at what is happening in my South Texas market. Do you have reality fatigue? I sure do. I'm here to unpack the latest data and trends for you.

The Current State of the Housing Market

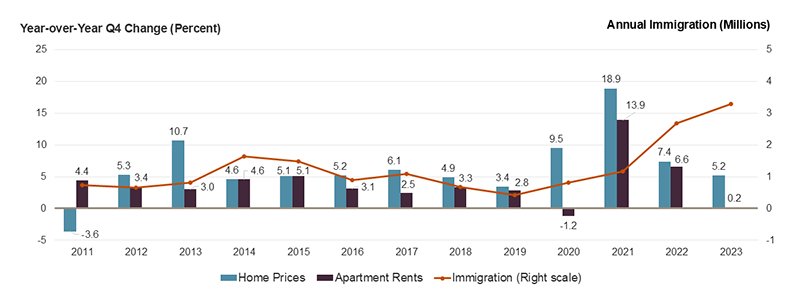

As we wrap up 2024, it's clear that the national housing market is anything but uniform. Different regions are experiencing vastly different realities, in politics and in our housing market. Nationally, home prices are set to finish the year with a 5% increase over the previous year. This increase comes despite a historically low number of home sales and a 27% rise in unsold homes on the market compared to last year. This discrepancy highlights the unique and bifurcated nature of the market across the country.

Regional Differences

The U.S. housing market currently exhibits a clear divide:

The Sunbelt: Regions like Austin, Tampa, and Phoenix have seen a significant increase in the number of homes for sale, reaching levels not seen in many years.

The Rustbelt: In contrast, areas like Chicago and Boston have barely seen any increase in unsold homes, remaining tight even compared to pandemic levels.

This division is primarily driven by migration patterns within the country, not immigration. Historically, there has been a significant movement of Americans from cities like Chicago and New York to sunnier locales in the Sun Belt, such as Arizona, Texas, and Florida. However, this migration has stalled in the last two years, particularly in 2024.

Understanding Migration Trends and Their Impact

The sudden halt in migration has sent shockwaves through the housing market, revealing a complex web of consequences that we have never seen before. In the South, where the once-thundering engines of relocation have sputtered to a halt, a glut of homes now lingers, threatening to upend the delicate balance of supply and demand.

Meanwhile, in the Northeast, the scarcity of inventory continues to fuel a fierce competition among buyers, leaving many to wonder if the dream of homeownership remains within reach and if they should even bother trying anymore until things loosen up. As we navigate this new landscape, one thing is clear: the migration trends of today will shape the housing market of tomorrow.

Economic Factors Influencing Migration

Several economic factors have contributed to this migration freeze:

High Costs: The cost of moving, coupled with expensive housing and mortgage rates, has deterred so many from relocating.

Job Scarcity: Despite low unemployment rates, the scarcity of jobs in desired locations adds another layer of complexity. (We all are tired of hearing that unemployment number…I know. Y’all need to be paying close attention to this. In my own circles I have many friends who have been laid off this past year and struggling to find work, including myself.)

Insurance and Climate Concerns: Rising insurance costs and the risk of climate-related disasters have also made moving to certain Southern markets less appealing. Water is a thing, y’all.

*As we move into 2025, the folks at Altos Research anticipate a slight loosening of this migration freeze, which could help increase inventory in the North and tighten it slightly in the South. But, I have my doubts about that.

Inventory Trends and Predictions for 2025

As of the last week of November 2024, there were 77,000 single-family homes on the market, marking a 27% increase in unsold homes compared to the previous year. This aligns with our expectations for where inventory levels would end the year. Interestingly, we are now only 18% below the pre-pandemic levels of November 2019, suggesting a gradual return to “normalcy” if not out right over supply in some markets.

Future Inventory Projections

Looking ahead to 2025, the inventory of unsold homes is expected to continue rising, though not as dramatically as in 2024. The pace of this increase will largely depend on broader macroeconomic factors and how the suits in the mortgage markets behave. If conditions align, we could see inventory levels approaching those seen before the pandemic by the end of next year.

Seasonal Variations and Market Adjustments

As the holiday season is upon us, the natural ebb and flow of the housing market is already taking effect. With the Thanksgiving holiday falling late this year, inventory levels are expected to dip below 700,000. This seasonal trend is likely to have a more pronounced impact on December's inventory levels compared to previous years. While some may dismiss the seasonal fluctuations, I find it frustrating that many people overlook the data and attribute the slowdown to the seasonal changes, without considering the underlying market dynamics.

Regional Market Dynamics: North vs. South

The bifurcation of the market into Northern and Southern segments presents distinct challenges and opportunities:

Dallas: The increase in available homes is notable, with more homes for sale now than at any time in the last decade.

Chicago: Conversely, there are 60% fewer homes for sale now compared to past averages, illustrating the tight market conditions.

This gap is mainly due to the slowdown in migration from cities like Chicago to Dallas. This trend has been affected by increasing moving costs and a host of economic uncertainties as we enter a new presidential administration.

Anticipated Changes in 2025

While the migration freeze is expected to continue into early 2025, there may be slight movements as conditions evolve. These shifts will be crucial for rebalancing the supply in Northern markets and possibly tightening the Southern markets slightly.

Deep Dive into 78130

As both a resident and an expert in Comal County real estate, I've witnessed firsthand the fascinating market dynamics over the past four years. 78130 is currently experiencing a palpable shift towards a buyer's market, with a predicted moderate decline in home prices over the next 12 months. I’m just going to call it a long needed market correction, even though pretty much everyone I know is in complete denial about that (...it’s just the holidays it’s always this bad…said every sales team lead and armchair housing market expert ever).

Although the potential for growth over a long period is still good, there are a few reasons why the outlook for the near future is not very positive. These include negative recent appreciation, elevated inventory levels, increased seller price cuts, and relatively high mortgage rates. Despite this, there is still strong demographic growth and high wealth levels in the area offer us a more positive counterpoint for the long term.

In a nutshell:

Short-Term Forecast (6-12 Months):

Price Down: Reventure App predicts a moderate decline in home prices, assigning a Home Price Momentum score of 38/100.

Declining Market Indicators: Four out of five key indicators point towards a declining market, including:

Negative Recent Appreciation: Home values declined by 4.4% year-over-year, with the typical home value dropping from $334,527 to $319,791.

Elevated Inventory Levels: The number of homes for sale is 28.7% higher than the seven-year average, signaling potential oversupply.

Increased Price Cuts: 26.3% of sellers reduced their asking price in November 2024, significantly above the historical average of 22.2%.

High Mortgage Rates: The current 30-year fixed mortgage rate of 6.43% sits above the five-year average, potentially dampening buyer demand.

Positive Indicator: Days on Market is currently 18.5% below the long-term average, suggesting continued buyer interest.

Long-Term Growth Forecast (10 Years):

Above Average Growth: Reventure App projects strong long-term growth, with a Long-Term Growth score of 65/100.

Growth Drivers:High Wealth/Income: The median household income is $87,936, and the poverty rate is a low 6.1%, indicating strong economic fundamentals.

Robust Demographic Growth: The area witnessed a 30.2% population increase in the last five years.

Challenges:Below Average Affordability: The Home Value/Income Ratio of 3.64x is near the US average but suggests affordability challenges for some buyers.

Overvaluation: Current home prices are estimated to be 3.3% overvalued compared to long-term norms.

For My Investor’s Outlook:

Average Returns: Reventure App assigns an Investor Forecast score of 53/100, indicating returns similar to the US average over the next decade.

Positive Factors:Strong demographic growth supports long-term appreciation potential.

A 3.3% overvaluation suggests potential for future price appreciation.

Negative Factors:Below average historical appreciation (NaN% over the last 15 years).

Poor rent growth (-0.42% from 2019-2024).

A low cap rate of 4.3% indicates limited cash flow potential for investors, ranking in the 0th Percentile of all housing markets in America in terms of cash low yield.

Note: The "NaN%" figures in the reports indicate missing data, potentially impacting the accuracy of certain long-term projections. Further investigation is required to determine the missing data's significance, y’all.

A note for my investors: The housing market in 78130 has been experiencing a stall out my friends for quite some time now, with short-term price declines anticipated. Although this will create opportunities for my buyers, my investor buyers should proceed cautiously due to limited or down right non existent cash flow prospects. However, the long-term outlook remains positive in my opinion, fueled by strong demographic and economic fundamentals. However, affordability and overvaluation concerns could impact future growth my friends. One way I encourage folks who already live here to raise their voice and combat future appraisal overshoots is to protest your property taxes yearly!!!

Looking Forward: Hope?

I’m not going to sugar coat it my friends, as we approach 2025 the U.S. housing market remains a multifaceted and polarized environment. There's no denying the gravity and the complexity of the situation. The pronounced disparity between Southern and Northern markets, largely influenced by evolving migration trends, does not bode well for next year. Most professionals won’t tell you this, but I will.

The current migration freeze, influenced by high costs, job scarcity, and climate concerns, has created an oversupply in previously popular Southern destinations while maintaining tight conditions in Northern markets. However, I can’t be totally cynical as we enter 2025. There is potential for a slight thawing of this freeze, which could begin to rebalance these regional disparities. I mean, quite literally anything could happen.

The inventory trends projected for 2025 suggest a gradual return to pre-pandemic levels, albeit with continued regional variations to be expected because the housing market is so hyper local. I’m putting out the positive vibe for potential normalization that could bring relief to some markets. However the sad truth about the housing market is that it’s not possible for every market across the us to be simultaneously winning, and there will be significant challenges to offset the wins of others.

Ultimately, the housing market's future will be shaped by a combination of economic factors, migration trends, and regional dynamics. As we move forward, it will be crucial for buyers, sellers, and investors to stay informed about these nuanced market conditions and adapt their strategies accordingly. What’s my motto kids? Adapt and survive.

The bifurcated nature of the current market serves as a reminder that in real estate, location matters more than ever. As we navigate through 2025 and beyond, understanding and responding to these regional differences will be key to making informed decisions in an increasingly complex housing landscape. If you or anyone else you know need help, advise, or a shoulder to take the weight of your uncertainty…I got your back.

Don’t like reading? Greg and Sarah have your back! Here’s the Deep Dive.

Is the Comal County Housing Market Cooling Off?

"Hello! As your trusted real estate expert, I'm excited to share the latest insights on the Comal County housing market, focusing on the 78130 zip code. Let's explore the data to gain a better understanding of what's in store for home prices in this area."

Hey, neighbors! It's your friendly New Braunfels REALtor here, back with an update on what's happening in our neck of the woods. Let's explore the Comal County data to gain a better understanding of what's in store for home prices in our area. Specifically, let's dive into the 78130 zip code and see what the data tells us what where all dying to get a feel for, the future of home prices in Unicorn Country.

Now, if you've been following along lately, you know things have been shifting. While it’s been a strong seller's market for a while, there are signs pointing towards a potential cool down. Don't worry, this isn't necessarily a bad thing! It could mean a desperately needed more balanced market for both my buyers and sellers.

Here's the deal: The good folks behind The Reventure App, which analyzes key market indicators, predicts a *moderate decline* in home prices for 78130 over the next year. Why? Let's break it down:

Recent Comal County Property Appreciation

We've actually seen home values dip slightly by 4.7% over the past year. This suggests a softening market, and that downward trend might continue.

Days on Market: Homes are lingering a bit longer before being snatched up. At 57 days on average, it's not a drastic change, but it does indicate a shift in the balance of power.

Historical Days on Market Forecast, New Braunfels, TX

Mortgage Rates: Ah, those freaking interest rates! They're still hovering above the long-term average, keeping it a bit tougher for some buyers to jump into the market.

Inventory Levels: Here's a big one – we've got more homes for sale than usual. In fact, inventory is up a significant 38.4% compared to the average. More choices for buyers often translate to downward pressure on prices.

Historical Inventory Forecast, New Braunfels, TX

Price Cuts: More and more sellers are willing to negotiate, with a whopping 43.8% slashing their asking prices recently. This is a strong signal that sellers are adjusting to the changing market.

Historical Price Cuts Forecast, New Braunfels, TX

What does this all mean for you?

For my Buyers, this could be your chance to snag a great deal! With more inventory and motivated sellers, you might have more negotiating power.

For my Sellers: Don't panic! This isn't a crash, but it's wise to be strategic. Pricing your home competitively and showcasing it in its best light will be key.

Remember y’all, this is just a forecast, and the real estate market is constantly evolving. As your local expert and advocate, I'm here to guide you every step of the way. Whether you're looking to buy, sell, or just want to chat about the market, give me a call!

"There have been few things in my life which have had a more genial effect on my mind than the possession of a piece of land." —Harriet Martineau

"There have been few things in my life which have had a more genial effect on my mind than the possession of a piece of land." —Harriet Martineau

Texas law requires all license holders to provide the Information About Brokerage Services to Prospective clients

⭐️⭐️⭐️⭐️⭐️ TESTIMONIALS ⭐️⭐️⭐️⭐️⭐️