What will the Donald Trump presidency mean for the US housing market in 2025?

Well, folks, it happened! The Trump Train rolled right back into the White House, and now we're all wondering what this means for our real estate market. Buckle up buttercup, because we're about to take a wild ride through what the red, white, and gold-plated world of Trump's second term could mean for real estate!

Well, folks, it happened! The Trump Train rolled right back into the White House, and now we're all wondering what this means for our real estate market. Buckle up buttercup, because we're about to take a wild ride through what the red, white, and gold-plated world of Trump's second term could mean for real estate!

Remember when we thought 2020 was unpredictable? Ha! Welcome to 2025, where the housing market might just be as dramatic as that reality TV season finale you all know you DVR’d!! But don't worry, I’m here to be your personal "Art of the Deal" decoder ring.

So, what's on the landscape for the next four-years? Will we see more apartment buildings and skyscrapers sprouting like weeds? Are we in for the potential of home prices rising? Or will the market be as plateaued as Trump's famous coif?

I’ll get into all the juicy details faster than you can say "You're fired!" at a bad property listing. From potential tax shakeups to infrastructure bonanzas, it’s going to be an interesting first year back in the Oval Office for Trump. My goal is to help translate all the political talking head’s jargon into real talk for your real estate decisions. Ready to make your real estate portfolio great again? Let’s dive into it.

The Influence of Trump's Election on Mortgage Rates

One of the first questions that comes to mind with Trump's election is: How will it affect mortgage rates? Interestingly, there has been a noticeable spike in mortgage rates since mid-September, with rates climbing back to around 7%. This rise has left many puzzled about the underlying causes. A significant factor to consider is the "Trump trade." A tweet from Jim Biano, president of Bianco Research,LLC highlighted a correlation between Trump’s betting odds to win the election and the 10-year US Treasury yield. As Trump's odds increased, so did long-term interest rates, suggesting that the market anticipates higher long-term rates under Trump's presidency.

Despite Trump being a pro-business figure who has historically pressured the Federal Reserve to cut interest rates, his presidency might paradoxically be associated with higher borrowing costs. This could potentially dampen home buyer demand. The Committee for a Responsible Federal Budget estimates that US debt will rise by $7.8 trillion from 2026 to 2035, largely due to Trump's fiscal policies. Moreover, Trump's penchant for tariffs, including a proposed blanket tariff of 10-20% on all imports and even higher tariffs on goods from China, could lead to inflationary pressures, further pushing up interest rates and mortgage rates.

Trump's Potential Impact on Home Buyer Confidence and Market Dynamics

Despite the possibility of higher mortgage rates, Trump's pro-business stance could boost economic confidence and optimism about the housing market. This was evident from past data, such as the mortgage purchase application index, which saw a significant increase following Trump's election in 2016. This suggests that Trump's election could initially inspire confidence among potential home buyers, potentially stabilizing or even increasing home prices.

Slow down though! The current state of the housing market presents new challenges. Affordability metrics are at their worst, with the monthly cost of buying a home now reaching $2,800, a stark increase from $1,200 when Trump first took office. The typical home buyer now spends 40% of their income on mortgage costs, up from 24% in 2016. High mortgage rates and continuing stringent qualification criteria for mortgages might (could and would) continue to lock out many prospective buyers, raising questions about the real impact of presidential policies on the housing market's fundamental issues.

The Looming Threat of Foreclosures and Government Intervention

Looking ahead to 2025, another significant concern is the potential increase in foreclosures. Trump's less hands-on approach compared to the Biden-Harris administration could see a rollback of forbearance and loss mitigation efforts that have so far prevented many foreclosures. Data from the November ICE Mortgage Report, The nation's leading source of mortgage data and performance information, covering most of the market, indicates a worrying trend: early-stage delinquencies for 2024 vintage originations have reached 1.7%, the highest in 16 years. This spike in delinquencies, particularly among VA and FHA loans, could herald a wave of foreclosures, especially if Trump reduces government intervention in the mortgage market.

The Biden-Harris administration has taken steps to help prevent foreclosures, like automatically enrolling borrowers who've fallen behind on their payments into more affordable plans and making it tougher for lenders to take away their homes. While some folks have raised concerns about using taxpayer money to help homeowners who don't have much equity in their properties, the goal is to keep people in their homes and avoid the chaos that comes with a surge in foreclosures. If the Trump administration were to reverse these policies, it could lead to a rise in foreclosures, which could have a ripple effect on the housing market and even drive down home prices.

The Role of Fannie Mae and Freddie Mac in Trump's Housing Policy

Get ready for a potential shake-up in the world of government-backed mortgages, y’all! The Trump administration is considering privatizing Fannie Mae and Freddie Mac, two giants that support around half of all mortgages in the US. If they sell off a chunk of their government stake to private investors, it could significantly reduce the government's role in the housing market - a move that aligns with Trump's more hands-off approach to economics.

So, what does this mean for the housing market? Well, privatization could lead to higher mortgage rates since the government's backing would be reduced. This could make it tougher for buyers to afford homes and impact market stability. On the other hand, it could also lead to more competitive practices in the mortgage lending market, which could be a good thing!

*Fannie Mae financed home purchases for millions of American soldiers returning from World War II. The nation’s economy grew rapidly and the liquidity Fannie Mae provided allowed mortgage lenders to have the cash on hand to meet the demand.

Are you wondering who Fannie Mae and Freddie Mac are? They're two government-sponsored enterprises (GSEs) that play a huge role in the US housing market. Fannie Mae was created in 1938 to provide financing for homeownership, while Freddie Mac was established in 1970 to provide financing for multifamily housing. Today, they're responsible for backing around half of all mortgages in the US, which is a whopping 31 million mortgages!

The short to the long of it is: Fannie Mae and Freddie Mac buy mortgages from lenders, package them into securities, and sell them to investors. This allows lenders to make more loans and helps keep mortgage rates low. The government provides a guarantee to these securities, which makes them more attractive to investors. By privatizing these institutions, the government would be reducing its role in the housing market and allowing private investors to take on more risk.

It's worth noting that privatization is just a proposal at this point, and there are many details that still need to be worked out. But if it does happen, it could have significant implications for the housing market and the millions of Americans who rely on Fannie Mae and Freddie Mac for their mortgages.

Trump, Tariffs, and Tangles: Will the Housing Market Duck or Dive?

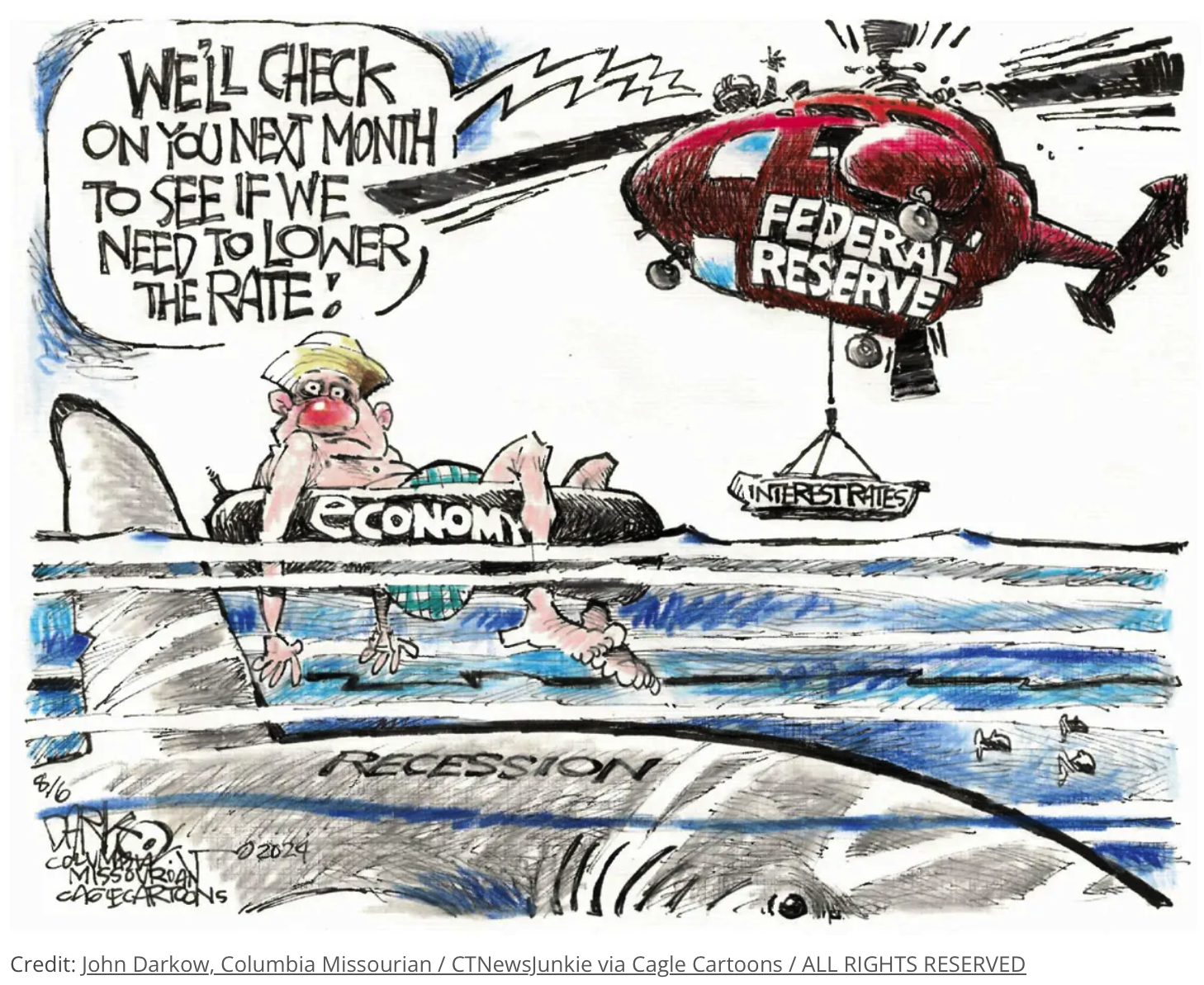

As we look ahead to Trump's presidency, it's clear that the broader economic landscape and the Federal Reserve's policies will have a huge impact on the housing market. And let's just say, Trump's relationship with Jerome Powell, the head of the Federal Reserve, has been a bit rocky. Trump has publicly criticized Powell and has been pushing for lower interest rates. The Fed's decisions, especially when it comes to interest rates, will play a huge role in shaping the direction of the housing market.

Trump's economic plans, which include big tax cuts and potentially aggressive tariffs on imports, could give the economy a short-term boost. But they could also lead to higher inflation and increased costs for consumers. And that's where things will get real interesting - these factors could either help or hurt our housing market, depending on how they interact with other economic factors like wage growth and employment rates.

For instance, if wages start to rise and people have more money in their pockets, they might be more likely to buy or invest in homes. On the other hand, if tariffs lead to higher prices for building materials and other goods, that will make it harder for builders to keep costs down and for buyers to afford homes. So, it's a complex picture my friends. Which will come first? The chicken or the egg? Will wages go up? Will building get cheaper? Unfortunately, we'll just have to live through these factors playing out to get a true sense of what the future holds for our housing market under Trump's presidency.

What’s Good in the Hood? The Importance of Being Aware of Local Market Fundamentals

While national policies and economic trends are important, the most critical factors for home buyers and investors are often local market conditions. Understanding the fundamentals of your local housing market, such as cap rates and historical price trends, is critical for making eyes wide open decisions. Cap rates, for example, provide valuable insight into the potential return on investment in different regions and can indicate whether it's a favorable time to buy or invest in a particular area…so don’t ignore them!

When it comes to investing in a single-family rental home in Texas November 2024, the right capitalization rate (cap rate) depends on a few key factors. First and foremost, there's your personal risk tolerance. Are you looking for a steady income stream with minimal risk, or are you willing to take on more risk in pursuit of potential growth? If you're looking for stability, a cap rate of 4-5% might be the way to go. But if you're willing to take on more risk, a cap rate of 8-12% could be more appealing.

Some investors, particularly those with a more aggressive approach, tend to shy away from properties with cap rates below 8%. In fact, some may even require double-digit returns. However, it's essential to consider the diverse range of factors influencing investment decisions. A cap rate of around 6% can be considered exceptionally attractive in the market you are buying in! In Texas, for example, many homeowners have low mortgage rates, which can limit the supply of homes available for purchase. This can impact the cap rate you're looking for.

Finally, the property itself is a major consideration. What's the property's location, condition, and potential for renovation or redevelopment? These factors can all influence the cap rate you're looking for.

By considering these factors, you can get a better sense of what cap rate is right for you and your investment goals.

Will 2025 Be Better?

As we head into the new year, it's clear that the housing market is in ongoing trouble, and we're looking at a complex web of factors that will shape the market's direction. From new government policies (or lack there of) to economic strategies and the actions of the Federal Reserve, there’s a dizzying array of things to keep track of.

But here's the thing: while it's important to stay informed about national trends, it's your local market that will ultimately make or break your real estate decisions. This is not a new rule, it has always been the case. Whether you're a home buyer or investor, understanding what's happening in your own backyard is crucial. Too many get suckered into the shiny sales pitch before we do our homework.

So, what does this mean for your action plan? It means staying informed about both national trends and local conditions keeping an eye on the big picture, but don't lose sight of what's happening in your own community! Pay attention to your city government. Go to those city council meetings! Be a sponge! By doing so, you'll be better equipped to navigate and possibly predict the chaos of the real estate market in 2025 and beyond.

In the end, while geeking out on macroeconomic and political climates is certainly an important activity, it's really understanding local housing market dynamics that will ultimately hold the key to shooting for success in real estate investment and homeownership. Stay informed, stay local, and get ready to make some moves in the 2025!

AGAIN REMEMBER KIDS: ALL REAL ESTATE IS LOCAL, even if the White House looks more like Mar-a-Lago these days. Do you know what else is local? You are! It’s impossible to predict what the housing market under Trump will look like this time around. What you can know is that neighborhood and financial knowledge is POWER.

And don’t forget to get your buyer’s agency with a REALtor in your neck of the woods. If you’re in Texas…I’ll help you navigate your neighborhood market, whether you're in a blue county, a red county, or somewhere in the purple haze in-between!

Is the Comal County Housing Market Cooling Off?

"Hello! As your trusted real estate expert, I'm excited to share the latest insights on the Comal County housing market, focusing on the 78130 zip code. Let's explore the data to gain a better understanding of what's in store for home prices in this area."

Hey, neighbors! It's your friendly New Braunfels REALtor here, back with an update on what's happening in our neck of the woods. Let's explore the Comal County data to gain a better understanding of what's in store for home prices in our area. Specifically, let's dive into the 78130 zip code and see what the data tells us what where all dying to get a feel for, the future of home prices in Unicorn Country.

Now, if you've been following along lately, you know things have been shifting. While it’s been a strong seller's market for a while, there are signs pointing towards a potential cool down. Don't worry, this isn't necessarily a bad thing! It could mean a desperately needed more balanced market for both my buyers and sellers.

Here's the deal: The good folks behind The Reventure App, which analyzes key market indicators, predicts a *moderate decline* in home prices for 78130 over the next year. Why? Let's break it down:

Recent Comal County Property Appreciation

We've actually seen home values dip slightly by 4.7% over the past year. This suggests a softening market, and that downward trend might continue.

Days on Market: Homes are lingering a bit longer before being snatched up. At 57 days on average, it's not a drastic change, but it does indicate a shift in the balance of power.

Historical Days on Market Forecast, New Braunfels, TX

Mortgage Rates: Ah, those freaking interest rates! They're still hovering above the long-term average, keeping it a bit tougher for some buyers to jump into the market.

Inventory Levels: Here's a big one – we've got more homes for sale than usual. In fact, inventory is up a significant 38.4% compared to the average. More choices for buyers often translate to downward pressure on prices.

Historical Inventory Forecast, New Braunfels, TX

Price Cuts: More and more sellers are willing to negotiate, with a whopping 43.8% slashing their asking prices recently. This is a strong signal that sellers are adjusting to the changing market.

Historical Price Cuts Forecast, New Braunfels, TX

What does this all mean for you?

For my Buyers, this could be your chance to snag a great deal! With more inventory and motivated sellers, you might have more negotiating power.

For my Sellers: Don't panic! This isn't a crash, but it's wise to be strategic. Pricing your home competitively and showcasing it in its best light will be key.

Remember y’all, this is just a forecast, and the real estate market is constantly evolving. As your local expert and advocate, I'm here to guide you every step of the way. Whether you're looking to buy, sell, or just want to chat about the market, give me a call!

"There have been few things in my life which have had a more genial effect on my mind than the possession of a piece of land." —Harriet Martineau

"There have been few things in my life which have had a more genial effect on my mind than the possession of a piece of land." —Harriet Martineau

Texas law requires all license holders to provide the Information About Brokerage Services to Prospective clients

⭐️⭐️⭐️⭐️⭐️ TESTIMONIALS ⭐️⭐️⭐️⭐️⭐️